Executive Brief

Change Management Advisor

BCI

About BCI

Overview

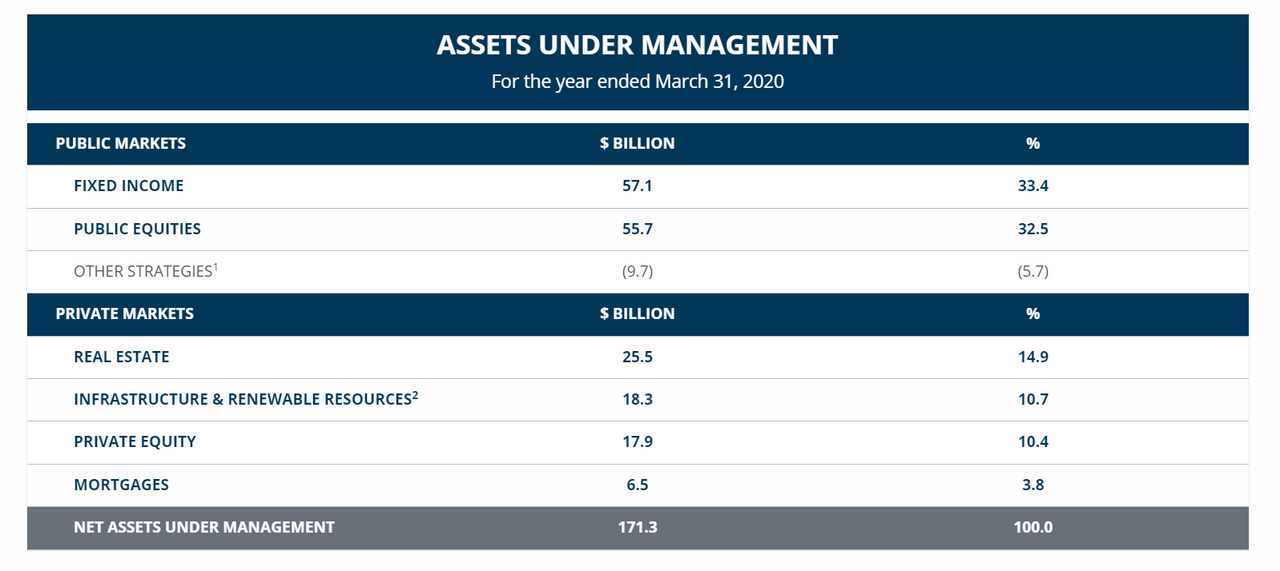

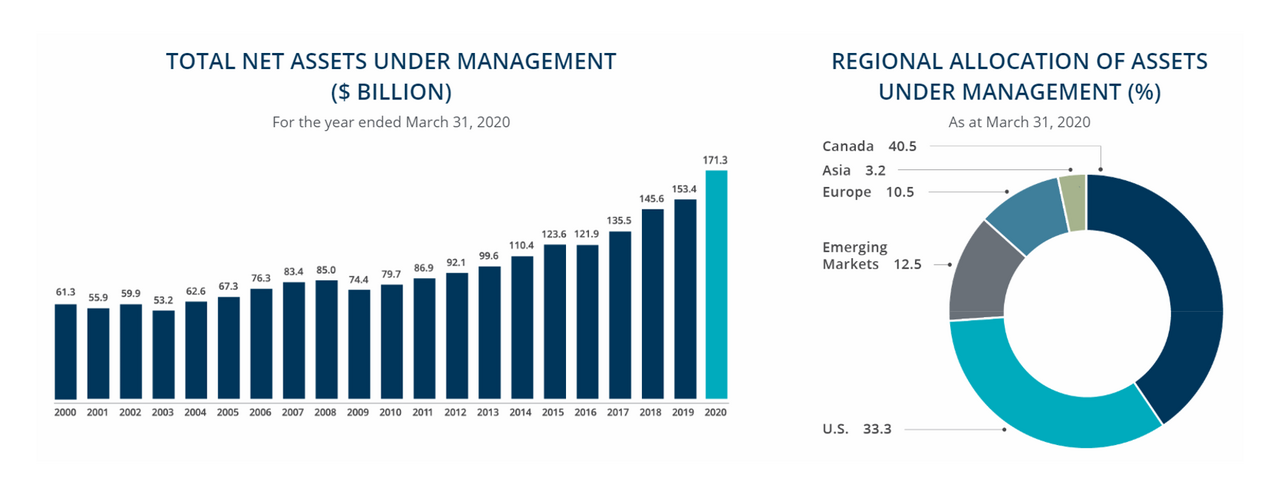

With $200 billion of AUM, British Columbia Investment Management Corporation (BCI) is a leading provider of investment management services to British Columbia’s public sector. BCI began operations under the Public Sector Pension Plans Act in 2000 with a role to generate investment returns that will help its institutional clients build a financially secure future. With a global outlook, BCI seeks investment opportunities that will meet its clients’ risk and return requirements over time. Its investment options span a wide range of asset classes, including fixed income; public and private equity; infrastructure and renewable resources; and real estate and mortgage.

Clients

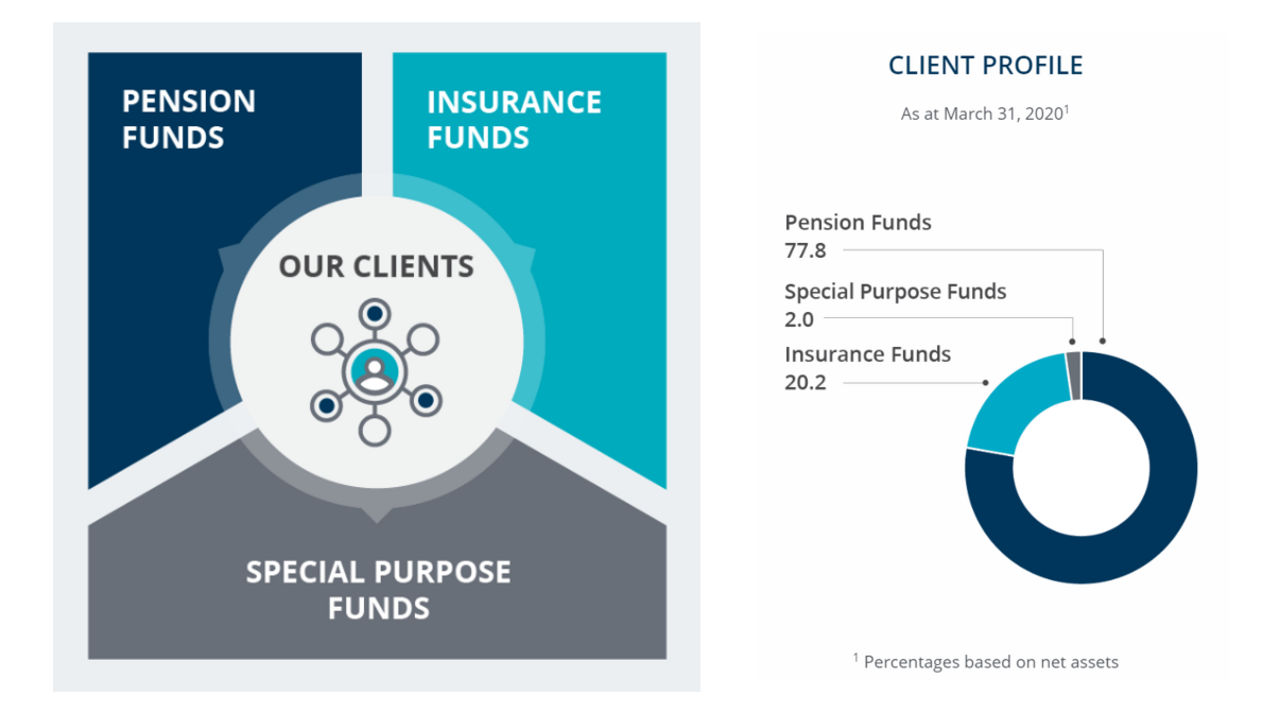

BCI focuses on understanding its clients’ different investment needs, whether managing pension funds, growing capital reserves for insurance funds, or generating income for trust funds. This includes learning about its clients’ investment objectives, liability profile, liquidity needs, and investment horizon. BCI assists with developing strategies that take into account its clients’ investment objective, risk appetite, and investment beliefs.

BCI invests on behalf of 12 public sector pensions plans, three insurance funds, and various special purpose funds. As its largest client group, pension plans account for approximately 77.8% of the total AUM. Ensuring their continued financial security is very important to BCI with 630,000 pension plan beneficiaries and 2.5 million British Columbian workers depending on its clients’ returns.

Governance

BCI is committed to maintaining world-class standards of governance. Good governance is critical to delivering long-term value for its clients and is key to its continued success. BCI operates under a dual accountability model as set out in the Public Sector Pension Plans Act and is responsible to its clients and the BCI Board. Clients establish their investment policies and management frameworks and determine the diversification of the portfolio and the eligible investments. The Chief Investment Officer is accountable to each client for their investment returns and the management of their funds.

Culture

BCI is considered one of Canada’s top employers with a culture that focuses on empowering employees in the continuous pursuit of excellence and success for its clients. The organization is the recipient of numerous awards, including Canada’s Top 100 Employers 2021, Canada’s Top Family-Friendly Employers 2021, and BC’s Top Employers 2021. With a global mindset and a local goal, BCI has a dedicated and diverse team that encompasses a wide range of professions and backgrounds who collaborate on common ground to ensure financially secure futures for British Columbians.

Investments

BCI is driven by long-term considerations due to the long-term nature of the liability profile of its clients. The organization has repositioned itself as an active, in-house asset manager with sophisticated strategies in order to continue to succeed within an increasingly complex investment environment. Its team of skilled investment professionals operates within a robust culture of investment risk management and collaborates across various disciplines.

- Private Markets BCI favours direct investments given a better alignment of interests with those of its clients who are increasing their exposure to asset classes that are illiquid and long-term in nature. The focus is on majority or co-controlling equity positions that allow for active governance

- Private Equity BCI invests in leverage buyout and growth equity opportunities in leading companies with a sustainable competitive advantage, value-added products and services, and talented management teams. Activities are sector-driven with a focus on industrial, healthcare, financial and business services, technology, and consumer/retail.

- Infrastructure BCI invests in core assets with low return volatility in developed markets with stable regulatory environments and high barriers to entry. The program is diversified by geographic region and sector, and includes regulated utilities in the water, electricity, and wastewater sectors as well as energy transmission, roads and high-speed rail.

- Renewable Resources BCI invests in companies in forestry and agribusiness industries with a focus on North America, Latin America, and Australasia. The exposure offers diversification, inflation protection, and cash-flow growth.

- Real Estate & Mortgages BCI invests in real estate and mortgage programs through its wholly-owned subsidiary QuadReal, a global real estate company. The portfolio spans 23 global cities across 17 countries and includes a strategic mix of premium assets ranging from office, industrial, multi-residential, retail, to land lease communities.

- Public Markets BCI combines index and active strategies to capitalize on opportunities within the global markets

- Public Equities BCI invests in a diverse portfolio in Canada, the US, and internationally in both developed and emerging markets. The program is managed by both internal and external managers and includes long-term investment themes and quantitative mandates.

- Fixed Income BCI invests in money market and bond portfolios that include global government bonds, corporate bonds, and high-yield debt. Strategies include yield curve positioning, duration timing, and securities selection. The portfolio also includes private credit participation with specialized external managers as well as foreign exchange hedging and trading.

As a long-term investor, BCI believes in responsible investing as companies that employ robust environmental, social, and governance (ESG) practices are better positioned to generate long-term value than similar companies with less-favourable practices. ESG considerations are taken into account in order to better understand, manage, and mitigate risks associated with long-term investments.