The Boyden UK Interim team have been consistently holding interim webinars throughout these strange COVID times. During our last conversation we discussed IR35, the implications and surveyed our network to assess their varying perspectives.

Protect your business. Reduce your risk. And maintain access to a dynamic talent pool.

Date: 3 February 2021

Location: Virtual Webinar

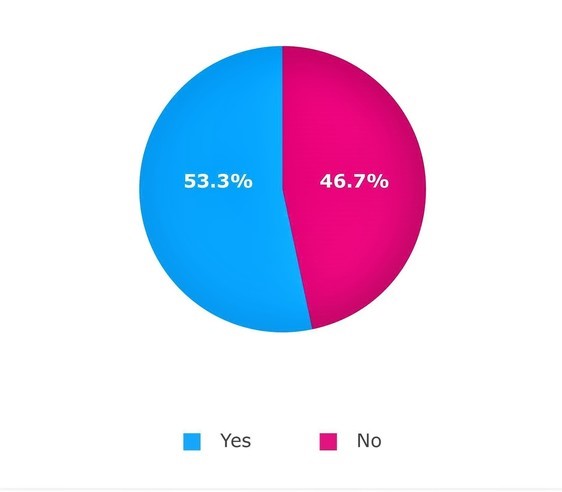

IR35 reform was delayed from April 2020 to April 2021, but there seems to be a widespread belief that we will not see another delay from HMRC and the reform will indeed be taking place in two months' time. Boyden was well prepared for the reform back in 2020 having worked with external IR35 experts throughout 2019 to assist us in developing our knowledge on how to assess whether a role is inside or outside IR35. We were ready to work with clients on how to reduce the risk for all parties by getting a correct assessment that would stand up to scrutiny from HMRC. IR35 is still somewhat misunderstood by clients and interims alike and indeed in a recent webinar that Boyden hosted, we identified that only 53.3% of interims were confident in assessing whether a role is inside or outside IR35.

Would you be confident assessing the IR35 status of a role?

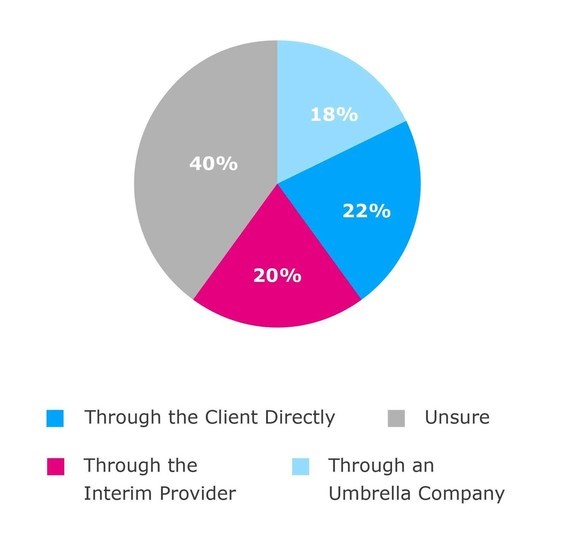

There is even greater uncertainty about how invoicing would work and who is responsible for making the PAYE deductions. There are many ways in which the invoicing and deductions can be managed but it is important for interims and end clients to work with experts in identifying the best solution for them.

How are you expecting to process NI & PAYE tax deductions for roles inside IR35?

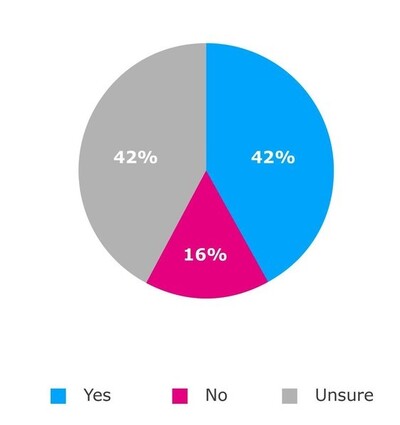

Pleasingly 75% of interims stated they would accept a role inside IR35 but 58% were either unsure or didn't know what the uplift would be on their charge rate.

Do you know the uplift in day rates for roles inside IR35?

So despite IR35 reform merely weeks away, there is still a lot of uncertainty

This is where Boyden can help our network of interims in establishing the IR35 status of opportunities, as well as working with our clients to make sure they can still access this excellent pool of interim talent available.

Boyden can work with you to assess whether the requirement for an interim is a project that scopes inside or outside IR35. We partner with insurance providers who will indemnify the decision of the IR35 assessment. This will cover all costs incurred against any future challenge from HMRC.

The UK interim team has a team of experts ready to help navigate the upcoming changes. We also have a suite of tools to properly assess whether an interim project is inside or outside of IR35. Please do not hesitate to get in touch with the team members below, Managing Partner Lisa Farmer, or Partners Claire Lauder and Guy Herbertson, if you have any concerns on the impact of IR35 on your business.

We look forward to speaking with you.