Boyden’s Steve Nilsen spoke to Bloomberg about gender diversity on boards in light of the Steve Wynn scandal.

This article was originally published on Bloomberg.com. Click here to read the original article.

By Christopher Palmeri and Jeff Green

Washington and Asia, the board of casino operator Wynn Resorts Ltd. had come under fire for weak corporate governance and deference to its founder and chairman.

The board, which oversees an $18.5 billion company with casinos in Las Vegas and the Chinese territory of Macau, has been criticized for overpaying Wynn and other executives while allowing perks such as corporate jets and a land deal between the company and its founder. Wynn shares sank as much as 7.3 percent to $167.06 Monday after a 10 percent decline on Friday.

“A board’s governance committee, auditing committee should have been looking at him,” said Jeffrey Sonnenfeld, senior associate dean for leadership studies at the Yale School of Management. “If they didn’t know this, how come they didn’t?”

Now the Wynn board’s mettle will be tested. The Wall Street Journal reported Friday that Steve Wynn paid $7.5 million in 2005 to settle a claim by a former manicurist at the company that he pressured her into having sex with him. Other former employees claimed Wynn coerced them into performing sex acts for $1,000 tips in a hotel spa and in his office.

Wynn, who turned 76 on Saturday, denied the allegations. “The idea that I ever assaulted any woman is preposterous,” he said in a statement.

Even with Wynn’s denial, the effect from the news was immediate: The share declines over the past two trading days have wiped out about $3.4 billion in market value. for the casino operator. Macau’s government met with local Wynn management to seek information, and its Gaming Inspection and Coordination Bureau stressed the importance in a statement of major shareholders, directors and key employees of casino operators meeting suitable qualifications.

The board, saying it is “deeply committed to ensuring the safety and wellbeing” of all employees, formed a special committee comprised of independent directors to investigate the allegations. The next day, Wynn resigned as finance chairman for the Republican National Committee -- a position that U.S. President Donald Trump had personally asked him to take.

Las Vegas Legend

Wynn is a legend in the casino industry and in his hometown of Las Vegas, where he built some of the most spectacular resorts on the Strip, including the Bellagio, with its musical fountain show, and the Mirage, which hosts nightly volcanic eruptions.

Elaine Wynn, Steve’s ex-wife, has accused the board of pushing her out after she criticized the chairman. She’s suing her former husband to get back voting control of her 9 percent stake in the company.

“The Wynn board may be the most compliant board of any major public company,” Elaine Wynn said in a court filing last May. “In only three instances in the history of the company has a director voted against Mr. Wynn’s position on any issue.”

Why the Harassment Claims Prompt Succession Concerns

It’s unclear what the board knew about Wynn’s 2005 settlement or his behavior. The company’s outside lawyers reviewed the settlement and determined it didn’t need to be shared with the board, according to comments made by Elaine’s lawyer at a Dec. 18 hearing. Elaine’s lawyers have been trying -- so far unsuccessfully -- to gain access to communications between Wynn and its outside lawyers about the settlement.

With his ex-wife’s stake and his own, Wynn controls about 21 percent of Wynn Resorts. The shares are common stock, with no extra voting power.

Wynn lost control of his previous company, Mirage Resorts, after shareholder criticism of his spending on art and hotel construction hurt the stock, giving rival Kirk Kerkorian an opening to acquire it with an unsolicited offer.

Governance Issues

Yet many of the same practices continue at his new company, Wynn Resorts, which went public in 2002. Institutional Shareholder Services Inc., the proxy advisory firm, last year gave Wynn Resorts its worst ranking for governance risk. In 2013, ISS notes, the company allowed Wynn to purchase any of the company’s aircraft in exchange for giving up an option to buy 2 acres of land on Wynn Resorts’ golf course. The company also leases Steve Wynn’s personal art for $1 a year, while picking up the cost of insurance, security and taxes.

“CEO pay has increased significantly, driven by large payouts under the annual incentive program and despite long-term underperformance,” ISS wrote in its report ahead of last year’s annual meeting. In 2015 and 2016, it recommended withholding votes to re-elect members of the board’s compensation committee, though it also advised voting for Wynn.

Glass Lewis & Co., another advisory firm, also recommended that shareholders vote against the company’s compensation package, citing “poor overall design” and “performance disconnect.”

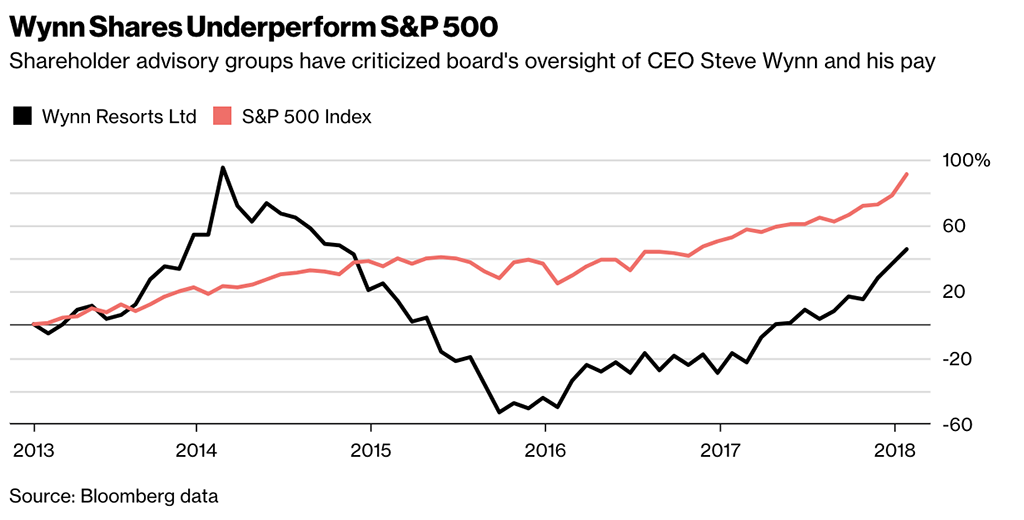

Through Jan. 25, the day before the reports surfaced, Wynn Resorts shares had risen 62 percent in five years, trailing an 89 percent gain in the Standard & Poor’s 500 stock index. They had a strong year in 2017, rising 95 percent, while Wynn Macau Ltd. doubled. The Macau unit fell 6.5 percent to HK$28.05 Monday in Hong Kong.

Board Composition

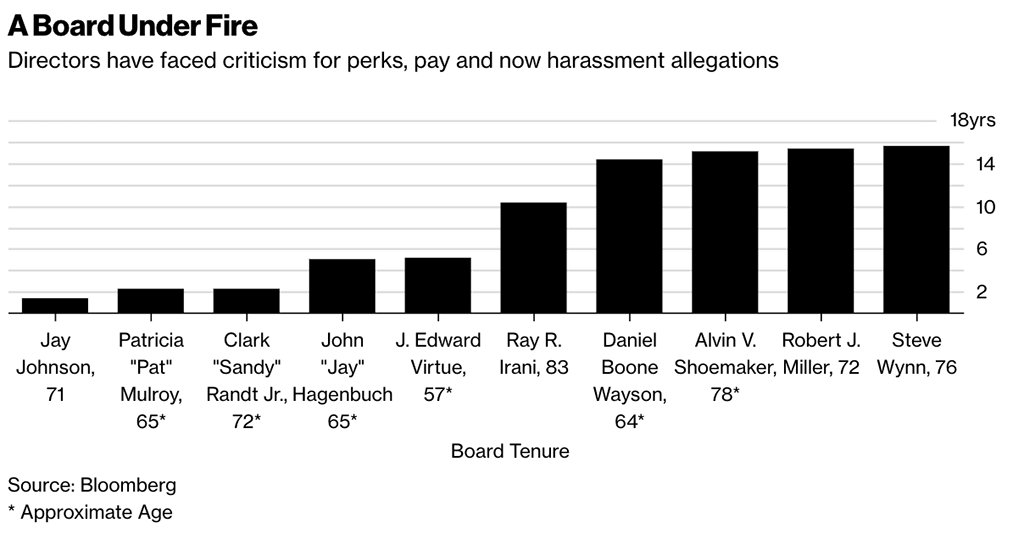

The 10-member Wynn board includes Clark Randt, who received a $600,000 consulting agreement in 2015 before his appointment to the board, and J. Edward Virtue, who managed money for the Wynn family prior to 2012, Glass Lewis noted.

The Wynn board is older but has shorter tenure than the average board, according to a comparison with data from executive recruiter Spencer Stuart. The average age of a director in the S&P 500 is 63, compared with 69 for Wynn directors as reported in the most recent proxy filing. The tenure for those directors was about 6.7 years, less than the 8.2-year average for S&P 500 companies.

Now that board has to decide what to do about the allegations against its founder.

Shareholder Richard “Trip” Miller, of Gullane Capital Partners in Memphis, Tennessee, said the board should hire an independent authority to investigate. Nita Chaudhary, of women’s rights organization UltraViolet, called for Wynn to be fired. Gaming regulators in Nevada and Massachusetts, where Wynn is building a $2.4 billion property on Boston Harbor, are also looking into the accusations.

‘Cut and Dry’

If the company has a harassment policy, the founder should be dealt with like anyone else, said Charles Elson, director of the John L. Weinberg Center for Corporate Governance at the University of Delaware.

“Cozy or not, directors have a fiduciary obligation,” Elson said. “They are in a very tough spot. But from a governance standpoint, it’s pretty cut and dry: They have to do their job.”

Patricia Mulroy, the former general manager of the Southern Nevada Water Authority, is Wynn’s sole female board member. That compares with the average of a 22 percent female board, as compiled by Spencer Stuart. Mulroy, who is on the board’s governance committee, on Friday was named as chair of the special committee investigating the allegations. The committee has started working and will be assisted by independent outside counsel, Wynn Resorts said in an emailed statement.

The Wynn situation is a classic argument for greater gender diversity in business, said Steve Nilsen, an Atlanta-based recruiter for executive search firm Boyden. Only 2 of 13 senior executives are women, Nilsen said, based on his analysis of company reports.

Gender Diversity

“You have to imagine that if there was greater gender diversity, there would be a lower threshold for this kind of behavior if it ever came to the board’s attention,” Nilsen said.

Boards are already more responsible than in the past for ensuring the fiduciary propriety of the company. And with growing evidence that diversity is good for the bottom line, the recent spate of sexual harassment incidents is an argument for requiring board oversight of ethics and behavior, he said.

Corporations may have to ask senior leaders to sign statements that they have not and will not conduct themselves, especially sexually, in a manner that jeopardize the company brand or financial health.

“If not knowing about financial wrongdoing is not longer acceptable, why would not knowing about these sorts of things be acceptable?” he said.

— With assistance by Edvard Pettersson, and Daniela Wei