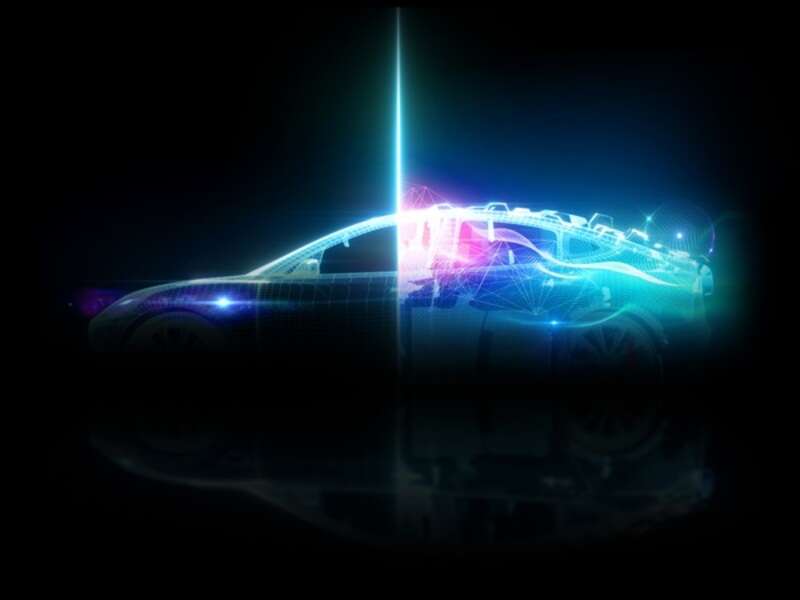

To survive in the new competitive environment and master the legislative challenges set by the EU, the automotive sector needs an approach reset

The prosperity in Europe has been strongly supported by the hugely successful automotive sector. According to ACEA – European Automobile Manufacturers’ Association, the automotive sector is home to approx. 13 million European jobs. It represents 8% of EU’s GDP and 7% of total EU employment, and funds roughly a third of the R&D investments in Europe. The automotive sector is a key driver for a futureproof, successful Europe.

Three key challenges for European OEMs are 1) new competition from primarily China and Tesla, 2) a need for a more cost-efficient distribution and 3) an enormous cost pressure from within Europe due to strict EU-emissions regulations, adding approx. EUR 2,000 to the end price of a new vehicle, so according to 2023-data from Renault Group.

The cost increases driven by EU-regulations shake up the European auto industry which loses their traditional advantage in the home market. The EU-regulations also are a key driver of cost reduction measures and could force increased sales mix of electric vehicles above and beyond natural consumer demand, and consequently push jobs out of Europe. The end effect could be a transfer of the initiative to the Chinese auto industry which leads in electrification of vehicles alongside Tesla.

While Tesla shows that electric vehicles can be produced at competitive cost levels in Europe at their Berlin Gigafactory, most other European manufacturers seem to struggle to reduce cost within their current, rather rigid organizational structures.

It is evident that the situation is very challenging at several levels. European OEMs are faced with high costs because of safety and emissions regulations, higher commodity costs, component shortages as well as new competition. As a consequence, it becomes unprofitable to produce small and affordable cars, such as the Ford Fiesta and VW Up.

The average price of a new car in Europe has increased significantly, e.g., to EUR42,790*) in 2022 in Germany. This makes buying a new car prohibitive for many of the less affluent European consumers and pushes the transportation cost to a new high of 13.8% of total household spending. Across all brands, according to a study by Autotrader (UK, March 2023), average new car prices in the UK have risen by a staggering 40% over the past five years.

The competition from China will intensify over the next years, and more new entrants from e.g. Vietnam or India will join the party, and the pressure on safety and emissions regulations will stay in one form or another. The European OEMs and suppliers need to rethink their organizations and manufacturing strategies, change their high-cost structures, and reduce product complexity significantly to stay competitive.

Agility, Innovation and Talent Challenges

As we have seen in several cases over the last few years, established players are often struggling to adapt to the new – increasingly software-driven and electric – reality. Big shifts are unlikely to happen with the current thinking and the existing organization. Based on our recent study, leadership teams are focusing on more agile decision-making, building new businesses, and capturing ideas from all parts of the organization.

According to our 2023 research in 'Exploring adaptivity through strategy and talent,' the top noted driver of growth is innovation while 40% of organizations indicate that they need to strengthen this skill set within their leadership team.

Therefore, it is more likely that a successful strategic shift and new innovations will happen if the management becomes more diverse and is mixed with “fresh blood”, so to speak, from other regions and adjacent or even completely different, more agile industries.

There is clear evidence that executives expect challenges in recruitment of new talent (most concerned is technology with 76% and second is industrial with 66% of executives expecting challenges). While executives are aware of the challenges in recruitment of talent, often HR departments are not aligned or are unable to up the game. And as human capital is a top three driver of growth and essential to deliver change, the HR hiring strategies need a makeover, too.

At Boyden we understand the power of inspiring teams which aligns seamlessly with cultural transformation and improves agility and focus towards reaching long-term business goals over an extended period. We have also observed that both a company’s and its leader's reputation are a decisive factor for winning potential candidates.

At Boyden we take a holistic view, and with strong analytical tools and significant automotive industry experience and a world-wide presence, we can assist OEMs and suppliers strengthen their teams, enabling them to better master the challenges of today and tomorrow. Contact Morten Hannesbo or the Boyden Switzerland team to learn more.

*Publicly available data from the German Bundesamt for statistics (August 2023) & Statista (September 2023).