Articles & Papers

PE/VC Trends Report: Technology Edition

ESG Evolution

Private equity as global change agent through focus on ESG, climate and sustainability

- ESG investing is on the rise, projected by PwC to grow from 14.4 percent of total AUM in 2021 to 21.5 percent in 2026. Most investors want companies to report the relevance of sustainability factors to their business model.

- A shift in expectation from ‘green philanthropy’ to traditional and sustainable returns has altered the outlook for impact investing, changing favourable media coverage, employee approval and risk mitigation into value creation.

- 37 percent of PE firms rank value creation as the top driver for ESG activity.

- ESG-focused AUM exceeded $100 billion for the first time in 1H 2022. The most visible ESG strategy is the impact fund, which typically includes an explicit ESG agenda as part of the investment strategy.

- PwC confirms there is no longer a conflict between ESG and returns: 70 percent of 150 PE houses surveyed place value creation among the top three drivers for their organisation’s ESG activities. It is now standard practice for PE firms to consider ESG factors when sourcing opportunities, carrying out due diligence, forming post-acquisition plans and deciding on deal terms.

- LPs and GPs now have access to a number of tools and options to plan concrete strategies, set priorities, balance environmental and DEI initiatives and conduct on-going evaluations to monitor ESG progress.

- BCG shows how ESG is a source of value creation for private capital:

- ESG is a top priority for investors and is core to creating value: 93 percent of LPs would walk away from an investment opportunity if it posed an ESG concern; 50 percent cite better investment performance as a key reason to incorporate ESG.

- Funds at the forefront of applying ESG in private equity see significant financial returns from their investments, including stronger sales, lower costs, higher employee engagement and, ultimately, superior valuations.

- In PwC’s survey, one-third of PE respondents cite ESG as a primary driver of value creation in more than half of their organisation’s deals in the last year.

- Qualitative outcomes, typically associated with value creation, are brand enhancement, risk mitigation, competitive differentiation and client attraction/ retention.

- Read more on the topic:

BCG report

McKinsey report

Bain & Company report

PwC Survey 2023

Bain & Company insights

Private Equity International – operational excellence

"Private equity has been and continues to be a real catalyst for change globally, as all significant players have either created specific funds, allocations or invested in enterprises that have a significant impact on ESG, climate, or sustainability. The agile nature of private equity and the shift towards private capital will likely see this trend gain even more momentum as investors increasingly seek out this type of investment."

- Allan Marks

Managing Partner, Australia

Green and climate tech are top LP targets, second only to AI

- Climate tech deal volume increased to $196 billion in 2022. GPs seeking to invest in the sustainability transition can employ a range of strategies: brown-to-green; supply chain decarbonisation; green growth; enabling technology and investing in winners that already have proprietary or leading decarbonisation technology or capabilities.

- As businesses and governments strive to achieve net-zero, new markets for sustainable goods and services are expected to emerge. However, PwC research shows a misalignment in funding for climate-tech ventures; sectors accounting for 85 percent of global greenhouse gas emissions receive just 52 percent of climate-tech investment.

- Also, the majority of financing for green infrastructure flows into developed countries, even though developing regions such as Africa and Southeast Asia have significant capital requirements and a high degree of ‘investability’. There are promising opportunities for value creation, especially in sectors such as infrastructure, where gains accrue over long time horizons.

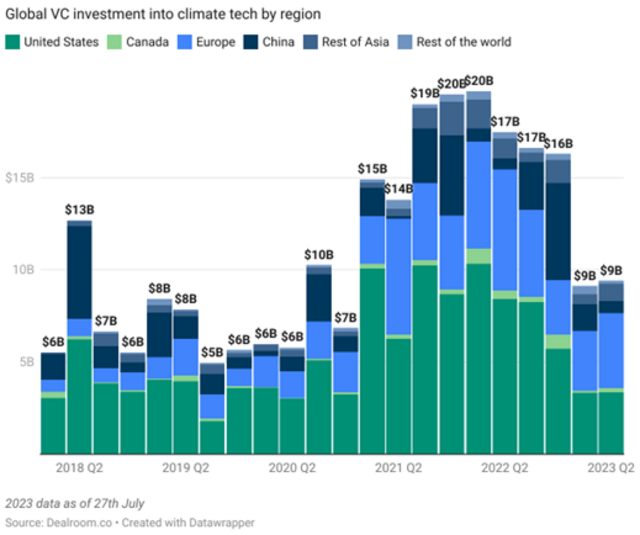

- VC funding in climate tech reached a record high of $70bn in 2022, marking a decade of VC investment growth x24. According to dealroom.co, the following slowdown in the VC market affected climate tech to the tune of -50% in H1 2023, compared with H1 2022.

- From a geographic perspective, over the last five years the United States has seen the most VC investment activity, followed broadly by China, with Europe making a step change in 2021, shifting the overall ratio, with flashes of investment in Q4 2021 and 2022 in China.

- VC investment in the US dropped significantly from $10bn in Q1 2022 to $3bn in Q1 2023, matching European levels, which fell from $6bn to $3bn in the same period. While US investment remains at $3bn, European investment crept up to $4bn in Q2 2023.

- Investment in China has fluctuated from $708m in Q1 2022, to $1bn in Q1 2023, and back down to 649m in Q2 2023, with a high of $5bn in Q4 2022. From Q4 2021 through 2022 there was meaningful participation in the rest of Asia, with robust momentum in 2023.

- PE firms can create more value by defining a superior portco ESG profile – in terms of impact on the environment and society – as well as alignment with sustainability-related market shifts and regulation. They can determine what changes are needed for a target to achieve such a profile, and work on those during the holding period, so the company is well prepared for an ESG-enhanced exit.

- The issuance of green, social and sustainability (GSS) bonds in Europe could increase from €500 billion in 2021 to €1.4 trillion or more in 2026. However, financing deals with low-cost green capital such as sustainability-linked loans (SLLs) are not yet common. Other potential sources of financing include transition funds, dedicated to helping companies achieve emissions-reduction targets, set up by some large financial institutions.

- Through 2024, asset allocation research by IPEM and Alix Partners shows technology and software is the top sector target for LPs, supported by significant expertise among GPs; in terms of specific technologies, LPs are targeting green and climate tech, second only to AI, where again there is exponential expertise among GPs.

- Read more on the topic:

McKinsey: Global private markets review 2023

Dealroom.co in partnership with Rockstart, guide to climate tech

pwc: Global PE responsible investment survey 2023

IPEM Allocation and fundraising trend report 2024

"Admist the rising significance of green and climate tech, functional leaders in this space are poised to play a pivotal role. As LPs prioritize sustainability, GPs driving the sustainability transition need leaders versed in brown-to-green strategies, supply chain decarbonisation, and green growth. Leaders capable of navigating these shifts and spearheading ESG initiatives becomes invaluable, ensuring companies are well-positioned for success in an evolving landscape."

- Sébastien Zuchowski

Managing Partner, Canada

Agri-food tech: a broad sector with opportunity across the value chain

- PE and VC firms are investing in food and agriculture for several reasons, most obviously the increased demand for food. The UN forecasts the global population to reach 9.3 billion by 2050; food production would need to increase by 50 to 60 percent.

- Agri-food tech is a broad sector with a multiplicity of opportunity. As population growth, food security, ESG and consumer preferences spur innovation, investors can profit along the value chain, while injecting environmental stewardship.

- Inflationary shocks and supply chain issues have highlighted food security, creating opportunity for investors to get involved in agri-tech to solve these challenges

- ESG factors and climate change have also driven significant investor interest in sustainable agriculture. In 2019, global agri-food systems accounted for just under a third of human-led greenhouse gas emissions, making them a key target for climate-related action, including regulatory regimes imposed by food law.

- While foodtech is one of the main VC funding segments, attracting $30bn in 2022, it experienced a stronger slowdown than many other sectors; late stage and breakout stages primarily accounted for a 70 percent drop in Q1 2023 vs. Q1 2021, with early stage showing more resilience. In H1 2023 it ranked in the top six in funding, attracting $7bn from VCs.

- In Q1 2023 PE firms invested nearly $10 billion in agriculture, a more than 2.6x increase since Q1 2013. A key benefit for recipients is the pursuit of ESG practices at a scale that would be unaffordable through more traditional forms of finance.

- As the sector evolves, business models are under scrutiny, with expectations of consolidation and increased M&A. Investors are also attracted by diversification: investing in agricultural sectors reduces overall risk because they are less correlated to other asset classes.

- Geographic differences also provide varied opportunities. Israel is a food and agtech powerhouse, with early innovation in data-enabled tech and IoT to address a shortage of natural resources. On the other hand, large territories such as China and Brazil are ripe for the development of new technologies.

- Government and fiscal incentives are also driving developments, for example in the United Arab Emirates. Abu Dhabi is striving to become a global centre for agricultural innovation, leveraging this to secure strategic investment, solve food security and further develop a knowledge economy.

- Read more on the topic:

McKinsey: Building food and agriculture businesses for a green future

Taylor Wessing: Value of food-tech and ag-tech

Vision magazine: PE’s role in transforming agriculture

Dealroom: Foodtech guide

"With PE and VC firms investing to meet the rising demand for food due to population growth, talent is vital across the entire value chain. Leaders capable of navigating innovation spurred by food security, ESG, and shifting consumer preferences are instrumental. Moreover, as government incentives drive developments, executives adept at aligning strategies with global initiatives, such as Abu Dhabi's pursuit of agricultural innovation, become crucial for organizations looking to secure strategic investments and foster a knowledge economy."

- Pierre Fouques Duparc

Managing Partner, France