Navigating challenges and trends in the Private Equity market, focusing on economic obstacles and shifts towards technology and value creation.

In the first Boyden Brief installment of 2024, the UK interim management team discussed the private equity (PE) market continuing its trajectory of resilience and adaptation, although it may be another year of navigating evolving economic conditions and shifting investor priorities.

It will not come as a surprise to anyone that 2023 was a volatile and somewhat flat market for Private Equity (PE). Starting with the obvious: continuing economic headwinds, soaring inflation and interest rates made it challenging to unlock liquidity and raise funds. This was layered with an ever-increasing value gap between what companies valued themselves at and what investors were willing to pay.

Our predictions going into 2024 were that we would not see a “hockey-stick” moment from the outset, although we expected activity to increase towards the back end of Q1, going into Q2. We also envisaged an increase in activity through carve-outs, value-creation of existing portfolio companies, increased pre-deal due diligence and publicly listed companies being taken private.

As we approach the end of Q1, hugely positive signs are evidenced through a flurry of activity in February, although we are not being complacent. As our interim management community is a hugely important network for Boyden, we wanted the first Boyden Brief of 2024 to be focused on the Private Equity market and future trends.

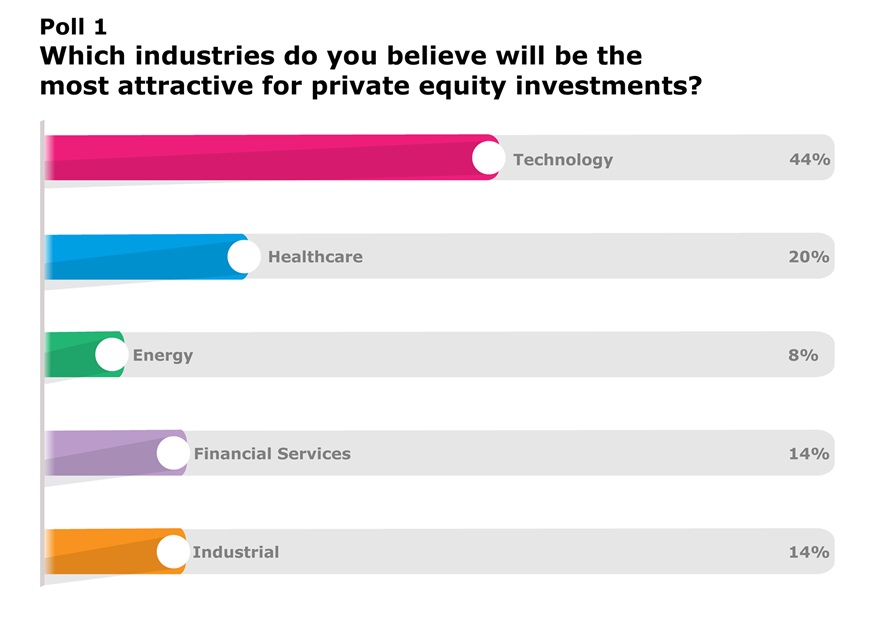

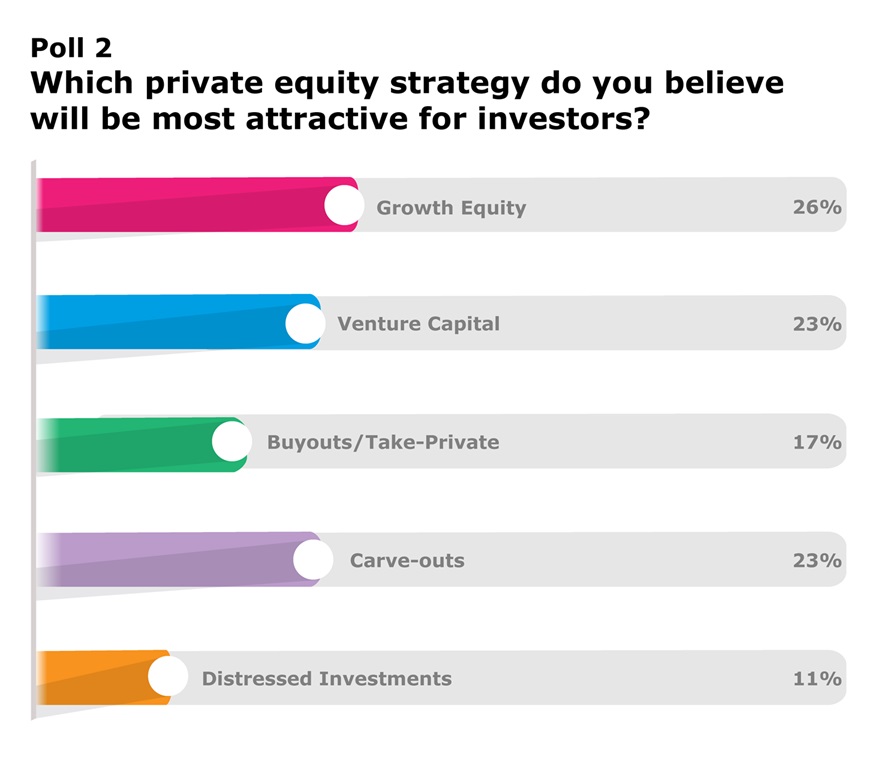

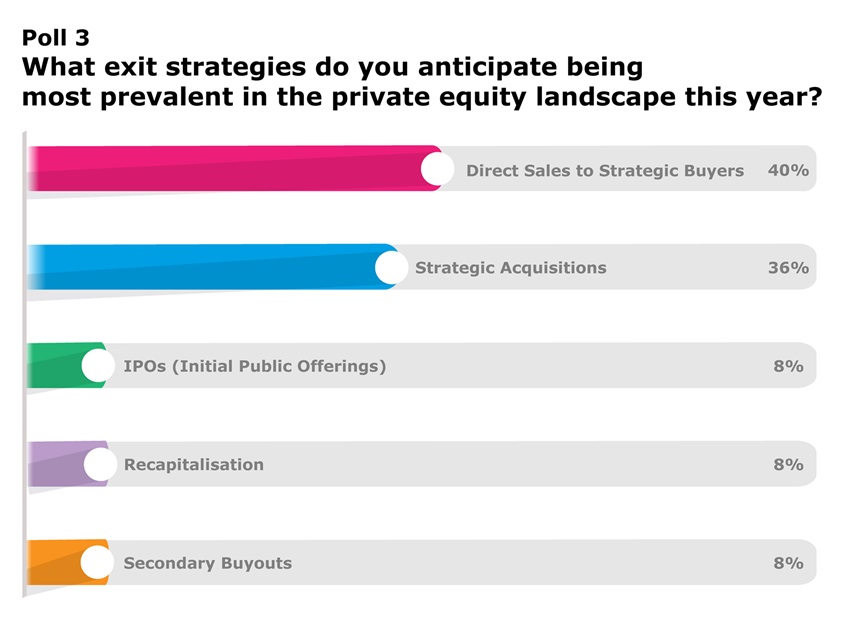

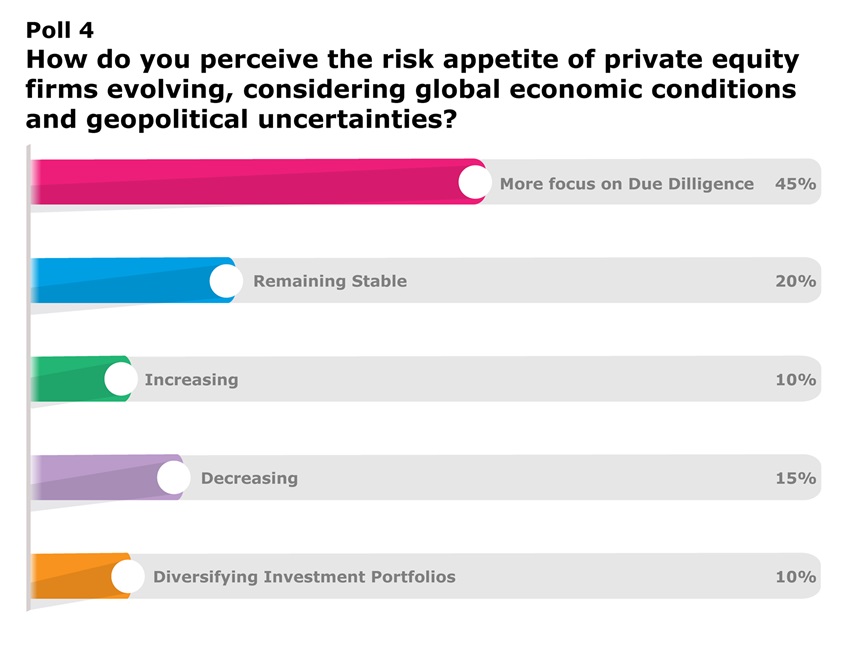

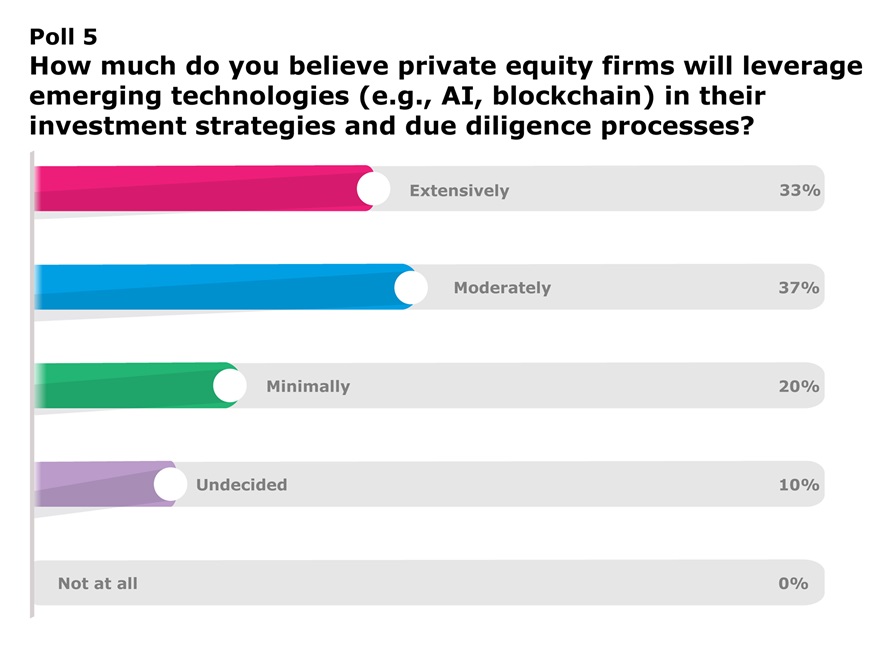

As is tradition with the Boyden Brief, we posed various poll questions to the interim management community with an emphasis on looking ahead to this year, relevant to the PE market.

It is no surprise that over 40% of the poll respondents think the Technology sector will be the most attractive for private equity investments. For the remaining options, it is fair to say that the healthcare sector will likely see sustained growth as it has done so since the pandemic.

The results align what we have and will likely to see this year – increased appetite in carve-outs and a focus on value creation and growth equity. Carve-outs will enable PE to give due attention to underperforming businesses as part of larger corporates whilst growth equity will be given to existing portfolio companies to improve their bottom line. We agree with 11% of participants seeing supressed appetite for distressed investments, especially in a cautious market.

Unsurprisingly only 8% of participants thought IPOs would be most prevalent; this is unlikely to change anytime soon. Both direct sales to strategic buyers and strategic acquisitions were ranked the highest, although we thought secondary buyouts may have scored better. Exit strategies in PE to PE firms is so often the preferred route to the seller, and buyer.

The picture remains as cautious, with 20% of participants thinking the market will remain stable, whilst 15% feel it will decrease. Almost half of participants feel that more focus will be placed on the pre-deal due diligence process, which will play into the hands of specialist interim managers.

The last poll focused on how receptive PE will be to leveraging emerging technologies with 38% choosing moderately and 33% opting for extensively. Clearly, there is a focus on PE to start incorporating technologies into existing portfolio companies and focusing on it as part of the pre-deal due diligence process.

The PE market remains robust, driven by a combination of factors including ample available capital, reducing interest rates, and investors' ongoing search for value creation.

Technology remains a key focus for PE investors, with significant interest in sectors such as software as a service (SaaS), fintech, and healthcare technology. The pandemic has accelerated digital transformation across industries, further fueling PE investments in technology-driven businesses.

Although not mentioned in the poll questions, Environmental, Social, and Governance (ESG) factors continue to play a prominent role in investment decisions, with PE firms increasingly integrating sustainability criteria into their investment strategies. This reflects a growing awareness of the importance of responsible investing and aligning financial objectives with positive societal and environmental impacts.

Overall, the PE market in 2024 remains opportunistic, although cautious, with investors adapting to new challenges and opportunities in an ever-changing global landscape.