The impact of COVID-19, potential recession, and HNW population trends are among the headlines in this quarter’s Market Overview.

The World in Potential Recession

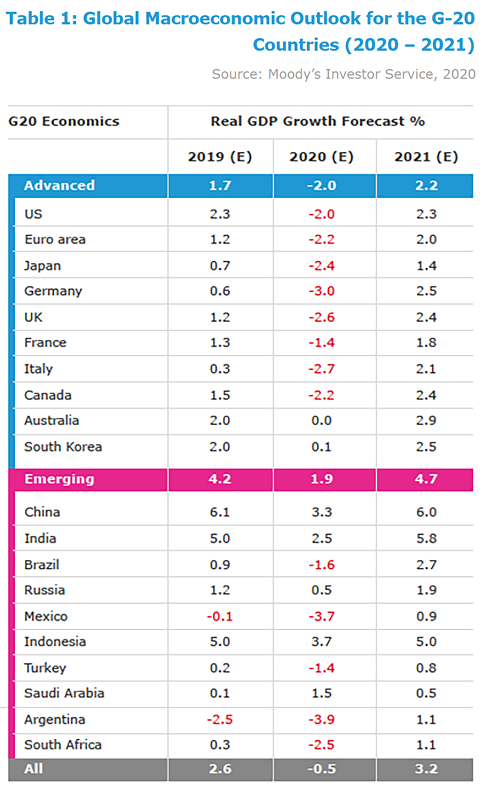

As cases of coronavirus keep spiking, disruptions to the global economy are increasing. As of March 27th 2020, Moody’s research has cut its global GDP growth forecast to -0.5% (Table 1). The number is uncertain more than ever though as the growth will depend on a number of factors including the severity and length of the outbreak, how quickly spending recovers when it abates, and the effectiveness of monetary and fiscal policy in providing support.

Over the months ahead, Moody's forecasts that job losses across countries will accelerate and the speed of the recovery will depend on whether job losses and loss of revenue to businesses is permanent or temporary. Moody’s commented that even in countries where governments are able to provide support through large and targeted measures, some small businesses and vulnerable individuals in less-stable jobs are likely to experience severe financial distress for the coming months.

Impact of COVID-19 on Wealth Management

Private banks and wealth managers have been reporting the spreading pandemic as the main fear among their clients. Covid-19 is first and foremost a major global health and humanitarian challenge which has been costing thousands of lives a day. Countries need to support their citizens, morally and financially, and scientists continue to work towards a vaccine. Wealth managers mentioned the lack of information by governments about concrete actions to find solutions as a key concern for clients, and the consequent impact of the virus on asset classes.

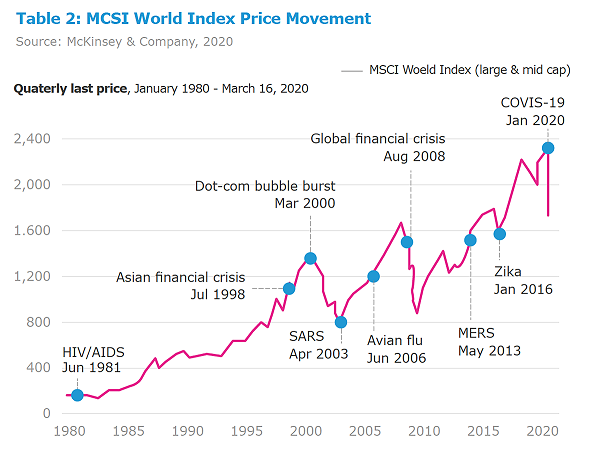

The consequences of the pandemic for economies, industries, MSCI World Index (large & mid cap) and service sectors are considerable. Volatility is one of the main challenges for wealth managers. According to the MSCI World Index, the approximate 30% drop from peak value in less than one month is comparable only to the 2001 collapse of the tech market, which saw a 44% drop over four years, and the global financial crisis in 2008, which saw a 40% drop in six months (Table 2).

Increased operational risks are also important challenges for the wealth management industry. People are wealth managers’ main strength; they serve the needs of clients, manage the portfolios and run operations. Firms must prepare for worst-case scenarios in which key personnel will be unavailable because of illness. If a firm is not able to continue addressing client needs (which increase during market volatility), or if a lack of personnel causes delays on decision-making due to unclear rights and powers of employees, this will cause client frustration and unhappiness among clients. Many firms, especially large and mid-size, have begun stress-testing remote work conditions and some regulators are calling on financial institutions to ensure additional measures are taken (such as monitoring and supporting staff morale) while carrying out their business-continuity. As an increased number of employees work remotely, the risk of cyber threats is also increasing and a successful cyber-attack has the potential to steal an enormous amount of client data, as well as cause significant legal and reputational damages to a company.

Substantial amounts of wealth have been disappearing over the past weeks due to the tumbling markets, with some client portfolios crashing to zero because of risky growth strategies. This has translated in margin calls for many bankers, as they seek more assets from clients if there is a risk that their portfolios reach a level of debt higher than allowed. This means that often clients are required to sell, and therefore share prices drop even further causing markets to crash.

World's Ultra-HNW Population Rising

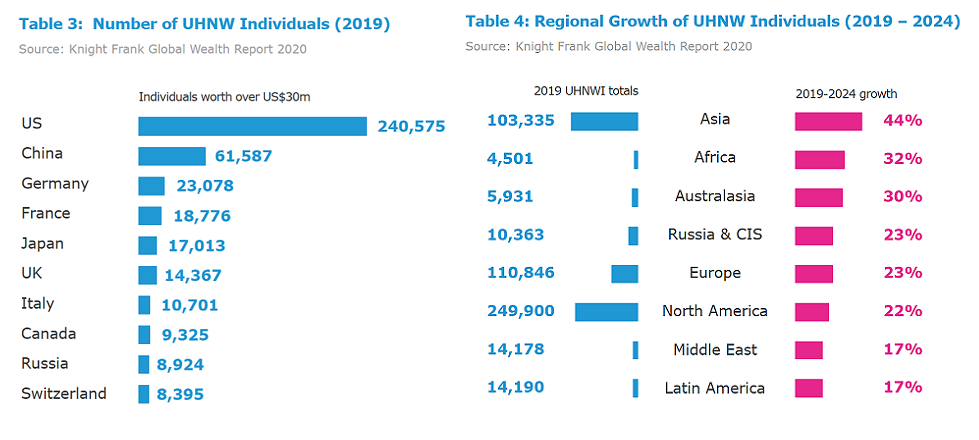

According to Knight Frank’s latest Global Wealth Report, the world’s UHNW population (net worth of $30 million or more) has been rising throughout 2019, up 6.4% from the previous year to a total of 513,244 individuals. The U.S. alone counted for almost half of the total number, followed by China and Germany that are although a distant number two and three (Table 3).

Knight Frank estimates suggest that the world’s UHNW population will increase 27% by 2024. Specifically, Asia's ultra-wealthy population is forecasted to grow by 44%, followed by Africa at 32%. North America is expected to continue to dominate in terms of gross number of UHNW individuals, with growth of 22% forecasted in the region over the next five years (Table 4). These estimates do not take into consideration the global slowdown due to the Covid-19 pandemic.

Multi-Family Offices: A Sought-After Model in a Consolidating Industry

A recent survey by Financial Advisor (2020) found that about 75% of UHNW individuals prefer to work with multi-family offices (MFOs); while 15% favor wealth management firms, 10% financial advisors and a smaller percentage use financial planning firms. Multi-family offices have been emerging as the preferred option for wealthy clients and they have been gaining increased attention and market share over the past decade. Plenty of large players (over $3 - 5 billion AUM) have been expanding their operations, while an increased number of bankers and wealth managers leave their institutions to set up these entities, either alone or with a small group of colleagues.

It emerged from the survey that the vast majority of UHNW clients like the responsiveness and the holistic service-oriented approach that multi-family offices provide. Clients rely to these firms not only to address issues quickly, but also to be able to anticipate potential issues and have solutions at hand. They often choose a family office over another for the expertise and experience of the team behind it and know that it’s a one-stop shop that can provide full and unbiased solutions to them. UHNWs favor the ability of these firms to provide not only wealth management services, but also to deliver an extensive range of support services, including administrative (such as tax compliance, bill paying and the management of properties) and lifestyle (such as concierge medicine and family security).

Despite a growing client demand for multi-family offices; the industry is expected to start consolidating. With a growing number of such structures globally, regulators have been implementing new frameworks to control the industry, which are expected to continue intensifying. In Switzerland for example, recent legislation has brought in new measures for multi-family offices that create more complexity and higher costs. This is an issue for the smaller players that are going to struggle with profitability and push consolidation. Just in Switzerland there are more than 2,500 independent wealth managers with an average of three members of staff and about CHF 200 million in assets under management which are expected to be hugely affected.

Luxembourg’s Five-year Sustainability Plan

Luxembourg for Finance, the development agency for financial services in the Grand Duchy, has unveiled a five-year sustainability plan with a focus on sustainable finance, innovation and cross-border expertise. The country aims to become a hub for impact investing, a sector that Luxembourg for Finance estimates to be worth $3 trillion by 2025, on top of its existing push towards green finance. It also plans to continue with its innovation efforts to create a new environment, products and services while retaining a stable environment and its AAA rating.

The country also plans to expand its role as a cross-border center and EU hub, building on more than 60 financial firms who have been strengthening their existing activities or setting up a new EU hub in Luxembourg due to Brexit. The wealth management and alternative funds space has been identified as key growing industries which the country plans to develop upon, especially within the family office and multi-family office space.

New Tax Regime for HNWIs in Greece

Greece launched a new tax legislation to push high net-worth individuals and entrepreneurs to relocate to the country. The legislation took effect from December 2019 and aims to get wealthy individuals to relocate their tax domicile to Greece and benefit from an alternate tax regime for their non-Greek source income. The individuals will pay an annual flat tax amount (€100,000) on their non-Greek source income without being required to report this on a Greek tax return and without the need to justify or document its origin, while they will be subject to Greek income tax according to the local rules and progressive tax scales on their Greek source income. Individuals who have not been Greek tax residents for the previous seven of the last eight years and whom have made an investment of at least € 500,000 in real estate, businesses or legal entities in Greece can apply to the scheme, and the eligibility for the alternate taxation regime is for 15 years. A similar regime has been available in Italy since 2017.

Growth of Family Offices in the Middle East

According to a recent survey by Intertrust, wealthy Middle Eastern families favor Europe for their wealth management and succession planning solutions outside of their region. Intertrust gathered findings from a survey of professional advisers servicing clients based in the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain; and specifically found that Jersey, Singapore, Switzerland and Guernsey are the four most favored jurisdictions.

The report also highlighted that family offices are the fastest-growing wealth structuring vehicle for wealthy families in the region, due to their investment management, ownership tracking and reporting capabilities. Although the multi-family concept in the Middle East is new; these structures are gaining interest in the region, especially in the UAE. Special purpose vehicles and corporate structures were ranked in second and third places respectively as favored structures. Intertrust also stated that three out of four advisors surveyed anticipate that wealthy families in the region will become much more global in the coming years, driven by the new generation’s interest to expand business interests beyond the region, and will therefore increasingly need international wealth management.

Singapore’s Efforts to Attract Asset Managers

A new law has been introduced in Singapore to make it easier for investment firms to register funds in the city-state. Singapore aims to attract funds and build on its traditional strength as a financial center, while also reducing the economy’s reliance on more volatile sectors such as trade. Until now, asset managers were required to incorporate special purpose vehicles for each fund, while the new law allows asset managers to create a single structure to hold a pool of assets and multiple sub-funds domiciled in Singapore, offering added confidentiality. Only a single set of service providers, financial statements and board of directors are now required for multiple sub-funds, that will in turn help asset managers reduce costs.

The latest data from the Monetary Authority of Singapore show that Singapore’s asset-management industry grew more than 5% to US$2.5 trillion in 2018; and Singapore hopes to continue building on this growth. The city-state recognised that while many asset managers have offices in Singapore, most of their funds are still registered in offshore jurisdictions. The new law hopes to revert this trend by offering investors more flexibility, and it will allow asset managers to use both Singapore and international accounting standards.

According to a recent report from the Singapore Exchange (SGX), private banks in Singapore registered a strong growth through 2019, with the average wealth management income of three of Singapore’s biggest banks growing by 18% year-on-year. The report outlined that the city-state has established itself as a top private banking and wealth management hub regionally and globally. As opposed to Hong Kong, which is mainly servicing the Greater China market, Singapore has been servicing Southeast Asian clients and increasingly international HNW & UHNW individuals.

Challenges for the U.S. Wealth Market

North America is the largest wealth market in the world and home to a diverse and sizable HNW segment that flourished over the past two decades. According to McKinsey, the industry totaled $13 trillion in assets back in 2000. By 2010, these assets grew 45% to $19 trillion with a profit margin of 16 basis points; and by 2018, client assets rose 64% compared to 2010 to $30.5 trillion, with margins of 18 basis points. In the U.S., financial assets have surged in value especially over the last decade, fueled by a stock market at record highs, low interest rates and President Donald Trump’s tax cuts.

Especially in the U.S., expats have been a lucrative segment for the industry. They are of diverse backgrounds, with Canada and the UK being the top feeder countries, and they are also responsible for a notable proportion of offshore investments given their propensity to invest in their country of origin. According to GlobalData’s US Wealth Management HNW Investors 2019 Report, about half of local and over one third of offshore investments in the U.S. are allocated into equities, and with continued market uncertainty expected in the future, greater importance is being placed on diversification, driving demand for alternatives at the expense of bonds.

Although the wealthy benefitted from a great recovery from the financial crisis and rising real estate prices, recent reports suggest that this trend is starting to soften. Bloomberg reported that pay increases for low-wage and high-wage workers have been diverging since 2018, with gains for low-paid workers outpacing the increase for high earners. According to the Case-Shiller Home Price Index, prices in New York and San Francisco flattened in 2019, and at the same time the two biggest industries that employ the wealthy in these cities, finance and tech, are expanding elsewhere due to lower fees earned on their services and the high cost of living in these traditional talent hubs. The upcoming presidential elections will also define the future; tax policy will either be kept the same for the wealthy, or should the Democrats win control, higher corporate, investment, and capital taxes are likely to be introduced, with possibly higher taxes on the wealthiest Americans.

Caribbean’s Cooperation with Europe

The European Union's Economic and Financial Affairs Council has removed the Bahamas from its list of non-cooperative jurisdictions for tax purposes at a recent meeting in Brussels. The Bahamas were deemed fully compliant with EU tax standards, after the country implemented all the necessary reforms to meet the block’s criteria on tax governance and tax cooperation. The Bahamas was one of sixteen jurisdictions that the EU determined had passed legislation to meet EU tax good governance principles, together with the British Virgin Islands and Bermuda, while four new jurisdictions were added to the list of non-cooperative tax jurisdictions, including the Cayman Islands.