Our Q2 report provides the latest updates on COVID-19 impacts and other key trends in wealth management.

Global Wealth Management Industry Forecast

The wealth management industry has been resilient over the past decades despite the multiple crises, such as 9/11 and the 2008 crash, with global wealth almost tripling to $226 trillion from $80 trillion in 2000. Last year alone saw an increase of almost 10% from 2018 levels.

With the novel coronavirus, wealth is expected to contract in the coming months and the future will depend on the recovery trajectory. Boston Consulting Group identified three outcomes of this recovery in its recent report titled “Global Wealth 2020: The Future of Wealth Management - A CEO Agenda”1:

- Best scenario: growth rebounds quickly and wealth is expected to increase to $282 trillion in 2024

- Slow growth: wealth falls to US$215 trillion in 2020 and grows to US$265 trillion in 2024

- Worst scenario: wealth falls to US$210 trillion in 2020 and grows to US$243 trillion in 2024

Asia (excluding Japan) and Latin America are expected to continue to create new wealth faster than developed countries during this time and women's wealth will increase faster than men's.

BCG suggests that given the challenges that wealth managers will face over the next two decades due to Covid-19, as well as consequences from changing client needs and expectations of a new demographic of clients; companies will need to adapt their business models, product and service offerings to better serve clients. These include developing more-personalized value propositions, enhancing ESG and impact-investment offerings, investing in digital and data, and designing state-of-the-art technology platforms.

COVID-19: New Opportunities

Even before the pandemic, the Wealth Management industry was troubled by slow growth, commodification, digital disruption, and eroding margins. According to a recent Simon-Kucher research2, average AuM fees have declined from 1.01% in 2015 to 0.74% in 2019, due to the fact that wealth managers have not really been able to recapture the high profit margins they experienced before the 2008 crisis. Nevertheless, the biggest global wealth managers started the new decade in a strong position, driven by a buoyant market, positive client inflows and a generally improved profitability and cost-income ratio. Although the Covid-19 crisis is expected to reverse this trend, with depressed markets reducing the overall asset levels of the rich, there is a general confidence that private wealth management will navigate better through this recession compared to other divisions of banking.

When markets slumped in March as the spread of coronavirus gathered pace, wealth managers’ trading volumes soared as wealthy clients reshuffled their portfolios, bumping first-quarter profits at the world’s biggest wealth managers UBS and Credit Suisse, demonstrating the resilience of wealth management during crisis. The question now is how to sustain profits as market volatility and trading volumes subside. Many wealth managers have been focusing on finding investment opportunities outside of public markets, with increased activity in this segment recorded in the last six months, and efforts by banks and wealth managers to build dedicated teams to manage these investments. Opportunities include investing in distressed assets and lending more to businesses in need of cash, with private equity becoming a focal point especially in the fields of healthcare and technology.

The Need to Fully Integrate Digital Technologies

The Covid-19 crisis has brought challenges that made businesses rethink their structures and business models. Although extreme market conditions come with some opportunities for wealth managers, the coronavirus pandemic has also highlighted structural issues, both existing and new, that if not tackled will make it challenging for private banks to reap opportunities. One of the issues emphasised by the crisis is the tendency of wealth managers to overlook technology as a value driver, side-lining it to more of a supporting role. The crisis forced many clients into digital interactions they would not have otherwise considered. It accelerated clients’ demand and value for digital wealth management services; requiring real time access and updates on their portfolios and digital tools to fully manage investments, and a seamless online account opening experience.

Although some digitization efforts have already started, a lot has gone into the front/client interfaces, and there is a need to integrate technology for every part of the value chain. This goes from the onboarding process with tools such as video conferencing and biometric authentication, all the way through to digital trading and reporting. According to a recent EY study3, nearly 45% of wealth and asset management executives say they need to re-evaluate their decisions related to speed of automation and digital transformation, due to Covid-19 challenges. Furthermore, due to the unpredictable pace of change, 72% of executives believe that there is a need for more frequent strategic and portfolio reviews, enabling areas of growth and under-performance to be identified at the earliest opportunity.

Companies should reprioritise and accelerate the role of digital technologies to leverage them as a competitive advantage to win and retain clients, while focusing on value differentiation which requires long-term strategic thinking and development. Alongside this, firms should also provide relationship managers with the tools and insights needed to communicate often and effectively with clients, wherever they are.

ESG Driving the New Generation of Investors

With millennials about to receive the greatest generational wealth transfer, wealth and investment managers must be prepared for a shift in investor attitudes and need to be able to understand the values driving this generation. ESG is one of the key drivers of millennials, a more informed generation demanding cleaner, greener investment portfolios and ways of money management that operate around environmental, social and governance principles. Many large wealth managers are already integrating ESG in their portfolios and have set targets to increase their exposure to these principles which will be crucial for firms to gain and retain the new generation of clients.

A recent global survey by Aberdeen Standard Investments (ASI)4 has found that ESG engagement is also increasing across private equity across Europe and Asia-Pacific, while North America seems to be lagging behind. The survey monitored the current level of engagement at both the General Partner (GP) and underlying portfolio company level. Europe is leading the way, with firms in the region being increasingly aware of issues such as climate change and are responding with action such as carbon offsetting and reducing their reliance on single-use plastics.

Guernsey’s New Green Private Equity Principles

Guernsey Finance has published a set of green principles for private equity firms looking to invest sustainably5. The guidelines are voluntary and aim to bring climate risks and resilience into the heart of private equity decision making based on "better climate disclosure and risk management". They are based on a two-pillar framework, one based on the process, comprising governance, culture, and transparency; and the other based on portfolio, covering risk assessment, assets, taxonomy, measurement, and reporting. Private equity funds domiciled or administered in Guernsey have a net asset value of more than £120bn.

UK Setting New Rules for Hong Kong British National Overseas

The UK has announced the extension of the visa rights of up to 300,000 Hong Kong British National Overseas (BNO) passport holders6, as a protection should China continue with the implementation of the Hong Kong national security law. It supports those who feel unnerved by China’s stranglehold on the city and would apply to those individuals who were issued the passport prior to the handover of the city from the UK to China in 1997. Currently, the passport holders can only reside in the UK for six months and are not offered citizenship, while the new legislation will expand this to twelve months, with a path to future citizenship. Although this is a good step, some have called for the legislation to go further and include the right for these passport holders to work in the UK and real fast-track to UK citizenship. This comes following a joint statement issued by Australia, Canada, the UK, and the US condemning the actions of the Chinese Government as it undermines Hong Kong’s “one country, two systems” framework.

Switzerland and UK to Negotiate a Bilateral Financial Services Agreement

A commitment was signed between the UK and Switzerland in June 2020, with the aim to make cross-border financial services trade between the two countries easier. The parties are set to negotiate an outcome-based mutual recognition agreement on financial services that will enhance cooperation and trust between them, reducing costs and barriers for UK firms accessing the Swiss market, and vice versa, and will cover a wide range of sectors. This development builds on the close relationship that already exists between the two countries and it is based on strong regulatory and supervisory cooperation between the UK and Switzerland.

Swiss Private Banking Consolidation Set to Continue

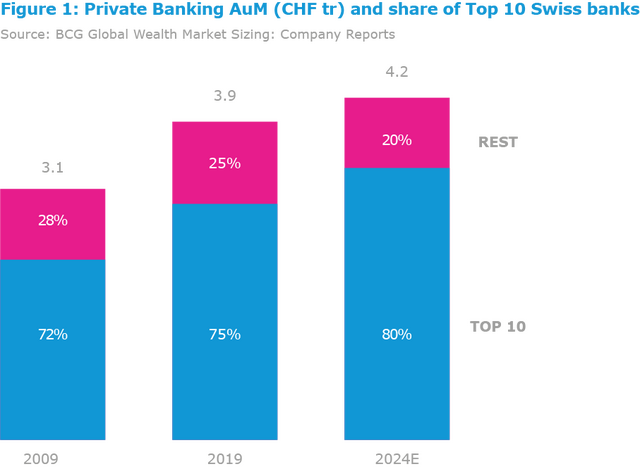

Swiss private banking consolidation, a process that has been rapidly increasing over the past decade, is set to continue faster due to the pandemic. A recent study by Boston Consulting Group (BCG) forecasts that one-fourth of Switzerland's private banks will disappear by 2025. The study found that in 2010 the ten largest private banks held 72% of assets managed in Switzerland. By last year, the number rose to 75% and is expected to rise to 80% by 2024 (Figure 1). This comes as private banks, despite slimming down on costs post-2008, have been affected by increased spending in the most recent years, including digitization as well as costs for legal and compliance.

Green and Sustainable Investments: An Opportunity in the UAE

Affluent and HNW investors in the UAE, the country with the highest number of such investors whose wealth is largely salary-based, have shown to be keen to capitalise on green and sustainable opportunities. According to the recent “Sustainable Investing Review 2020” of Standard Chartered Private Bank7, 72% of investors in the region are strongly interested in sustainable investing opportunities, and 39% are looking to allocate 15%-25% of their funds to these investments within the next three years. This interest increased as a consequence of the pandemic that pushed investors to focus on areas that are resilient against future crises. Despite that, the survey found that UAE clients were the least familiar with terminology, such as low carbon investing, compared to their peers in Hong Kong, Singapore and the United Kingdom, signaling an opportunity for wealth managers and private banks to inform, educate and help clients navigate these areas and meet social and impact goals that are of interest to them.

Growth in Africa: Family Offices in the Horizon?

In a continent still heavily influenced by traditional values and customs, most enterprises are family-owned. There are over 6,900 multi-millionaires in Africa and estimates suggest that the African wealth management market will grow by approximately 7% year on year between 2020 and 2030. The current second-generation entrepreneurs are critical to continuing the country’s business, although many of the founders of these businesses are often reluctant to cede control of the wealth they built and do not place significant emphasis on succession planning. Today’s second-generation entrepreneurs on the other hand are showing increased willingness to structure their wealth with succession planning in mind. Despite the concept of a family office being reasonably new in Africa, more and more of such structures are expected to grow in the next decade and increase in popularity, given the prevalence of family-owned businesses on the continent. These structures will help to have a holistic view of the family wealth, structures, succession planning and the transfer of wealth to the next generation, while also providing a more customised offering than traditional private banks and wealth managers.

Rich Asians Favouring Wealth Preservation

The number of HNW & UHNW individuals in Asia ex-Japan is increasing at a faster pace than any other continent. According to Knight Frank’s 2019 Wealth Report8, eight of the top ten countries by future growth of UHNW population over the next five years will be in Asia, with India taking the top spot at 39% growth, followed by the Philippines at 38% and China at 35%. It has also recently been found that 80% of wealth managers in Asia ex-Japan currently identify wealth preservation the top priority of UHNW clients, followed by absolute return (67%) and income generation (60%); while their preferred fund strategies lie in alternatives, multi-asset, and fixed income strategies. The preferences may have been shaped due to the volatility created by Covid-19. The outlook for thematic funds is also strong in Asia, particularly for healthcare and technology funds which are registering strong growth as resilient industries.

Hong Kong Instability and New Chinese Wealth Management Scheme

China has announced the details of a wealth management pilot scheme that links investments and financial services between the semi-autonomous economies of Hong Kong and Macau and mainland China. It is part of Beijing’s project to build a Greater Bay Area (GBA) economic powerhouse in southern China. The scheme will allow Hong Kong and Macau residents to invest in wealth management products sold by Chinese banks in nine mainland cities in the Greater Bay Area while also allowing residents in those cities to buy products sold by Hong Kong and Macau banks. China is also pushing a new futures exchange and plans to similarly pilot cross-border private equity investments. Details of the scheme and timings for implementation are still to be revealed.

The new scheme comes as China seeks to impose a new national security law on Hong Kong, a city-state that is suffering its worst economic and political crises since at least 1997. Many HNW & UHNW residents have been either reducing their Hong Kong exposure, opening offshore bank accounts, applying for alternative passports, or taking steps to ensure that they can withdraw assets at a moment's notice, in view of further distress caused by the political tensions. Rich Chinese are also expected to park fewer funds in Hong Kong on worries that Beijing’s proposed national security law for the city could allow mainland authorities to track and seize their wealth. Latest data show that more than half of Hong Kong’s estimated private wealth of over $1 trillion is from mainland individuals who have parked money there. Wealthy Chinese may like the law from the perspective of their love for the Chinese flag, but not from their asset protection perspective.

The U.S. in the meantime is in the process of rolling out measures that could restrict flows of U.S. capital through the Hong Kong market, in response to China’s Hong Kong security law. The move aims to protect U.S. investors from Chinese companies’ failure to adhere to American rules on accounting and disclosure. The U.S. is currently seeking recommendations from a Treasury-led group on possible actions to be taken, and a report with more details is expected in August 2020.

U.S. RIAs: A Consolidating Market and Possible Succession Planning Crisis

The U.S. RIA (Registered Investment Advisor) merger and acquisition activity has been intensifying over the past five years and valuations continued to rise. Covid-19 has, however, decreased the number of transactions recorded. According to a recent report by investment banking and consulting firm Echelon Partners9, there were a total of 46 wealth management M&A transactions in the first quarter. That is a decline from all-time quarterly high of 53 in the last quarter of 2019. The M&A activity is, however, expected to regain pace in the second half of 2020 once the worst of the pandemic has passed in America. The RIAs managed by aging advisers with five to ten years to retirement are expected to continue to drive exits from the industry, as founders look to reap the fruits of their hard work. Volatility is expected to contribute to accelerating these exits and therefore M&A activity, although valuations may fall as a consequence of higher and rushed sales.

According to the latest DeVoe RIA Next Gen Transitions Survey10, the current RIAs in business are most likely headed for a succession planning crisis, as the majority of large firms reported insufficient investment in the next generation of leadership and a lack of confidence in the next generation. The results showed that there is a lack of human capital management in RIAs, with 65% of firms not providing adequate performance reviews, 54% not having clear incentive compensation plans, and 49% not providing clear career paths for employees. The study also found that two-thirds of firms do not have a succession plan in place, with 57% of RIAs believing that a transition from founders to the next generation would be “bumpy” or worse and 13% thinking it would be a severe challenge.

1 Global Wealth 2020: The Future of Wealth Management—A CEO Agenda, BCG (2020); https://www.bcg.com/en-gb/publications/2020/global-wealth-future-of-wealth-management-ceo-agenda

2 Simon-Kucher & Partners (2020); https://www.simon-kucher.com/en-gb

3 EY Wealth & Asset Management (2020); https://www.ey.com/en_gl/wealth-asset-management

4 Private Equity ESG Survey: ESG ENGAGEMENT IN PRIVATE EQUITY ON THE RISE, Aberdeen Standard Investments (2020); https://www.aberdeenstandard.com/en/media-centre/media-centre-news-article/esg-engagement-in-private-equity-on-the-rise

5 Green Private Equity Principles, We Are Guernsey (2020); https://www.weareguernsey.com/literature/green-private-equity-principles/

6 Switzerland and UK to negotiate a bilateral financial services agreement, GOV.UK (2020); https://www.gov.uk/government/news/switzerland-and-uk-to-negotiate-a-bilateral-financial-services-agreement

7 Sustainable Investing Review 2020, Standard Chartered (2020); https://www.sc.com/en/banking/banking-for-individuals/private-banking/standard-chartered-sustainable-investing-review-2020/

8 The Wealth Report – 2019, Knight Frank (2020); https://www.knightfrank.com/publications/the-wealth-report-2019-6214.aspx

9 The ECHELON RIA M&A Deal Report, ECHELON Partners (2020); https://www.riadealbook.com/

10 DEVOE & COMPANY (2020); http://www.devoeandcompany.com/our-publications