“Leadership Unlocked” brought together senior leaders from across private equity to discuss the evolving challenges of leadership in PE-backed businesses. The conversation explored four critical stages of the investment cycle: pre-deal, post-acquisition, hold period, and exit.

Following the hugely successful client breakfast event that Boyden hosted in June, our Healthcare & Life Science (HC&LS) Practice was pleased to host the second event of 2025.

“Leadership Unlocked” was an intimate discussion, drawing together an accomplished group of senior leaders from across the investment and operational spectrum. Against a backdrop of accelerating change and growing complexity within private equity (PE)-backed businesses, guests explored the shifting dynamics and challenges shaping today’s leadership landscape. The event broadly focused on four stages of the investment cycle: pre-deal, post-acquisition, hold period and exit.

The session fostered open, candid dialogue among Chairs, Chief Executive Officers (CEOs), investors and operators, each sharing stories of success amongst honest reflections on the challenges inherent in building, evaluating and sustaining high-performing leadership teams.

The conversation naturally unfolded along the investment cycle, beginning with pre-deal considerations.

“Operators are critical for company growth and scaling; focus on building strong partnerships and recognising organisational gaps.”

Head of Life Sciences, Private Equity

Leadership readiness: the right operator at the right time

A central theme emerged swiftly: leadership readiness and rigorous team evaluation lie at the heart of sustainable growth. Several attendees spoke to the pivotal role of operators in scaling organisations, emphasising that robust partnerships, built on clear-eyed recognition of both strengths and organisational gaps, are fundamental. The self-awareness of individual leaders and executive teams, often achieved through external coaching and development, was cited as an essential leadership trait.

The discussion delved into how best to understand and align leadership capabilities with the portfolio company’s stage of evolution. Far from being a simple cliché, the maxim “horses for courses” was described as a guiding principle, demanding the humility and discipline to recognise when the right leadership is not in place, and the fortitude to act decisively in such moments. There was consensus that rigorous leadership assessment is a highly effective way to build this understanding, whether as part of the pre-deal due diligence process (less common) or post-deal evaluation of senior talent, ideally within the first 6-12-months following investment.

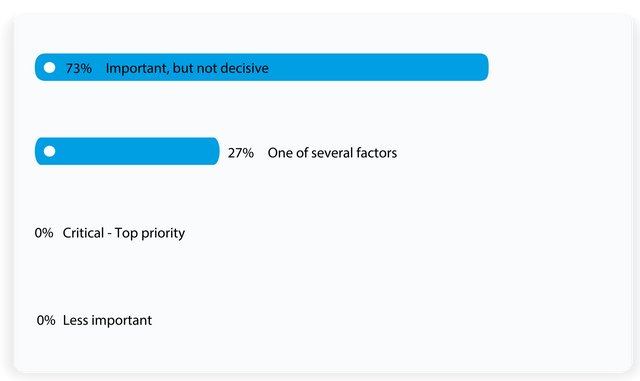

Poll insight:

When considering investing in a business, how critical is the existing leadership team?

Participants clearly see leadership as an important ingredient in an investment decision, but not the defining one. The absence of votes for “critical” suggests investors remain pragmatic: they expect leadership gaps to exist and are confident they can be addressed post-deal. In other words, an imperfect team doesn’t block investment - but it does shape the post-investment agenda.

As the discussion moved into the post-acquisition phase, attention shifted to the layers of leadership below the executive team.

“Bringing in external talent and engaging subject matter experts can drive value creation.”

Chief Executive, Healthcare and Education

Beyond the executive: upskilling and supporting senior talent

The conversation naturally turned to what follows post-investment, with particular focus on clarifying objectives for leadership teams across the investment horizon. Attendees broadly agreed that due diligence must move beyond established norms of interviews and psychometrics, demanding a proactive approach to identifying, upskilling and supporting key senior leaders below the executive tier.

Discussion reflected consensus around the hallmarks of successful leadership in growth environments: rigorous, evidence-based assessment, continuous development and an ability to lead responsively according to context and circumstance. Extended interviews and detailed psychometric profiling were valued, yet intuition and a profound understanding of the business context were acknowledged as also important.

Amid sectors facing profound disruption, the group stressed the necessity of ongoing learning and developmental support and a culture of resilience and transparency.

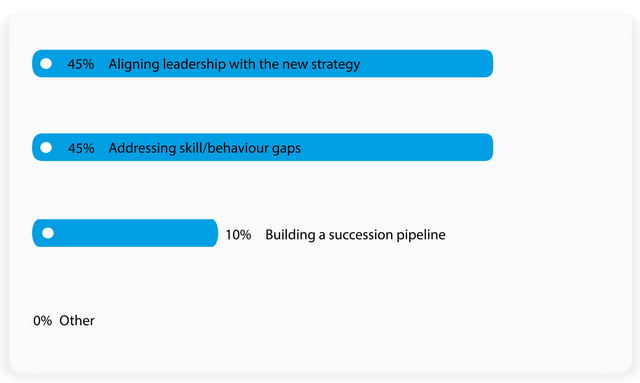

Poll insight:

What is the most common leadership challenge faced by an investor in the first year after investment?

The strongest early-stage challenges revolve around getting the leadership team pointed in the same strategic direction and closing behavioural or skill gaps. This reflects a familiar investor reality: once the deal is done, the work becomes less about who stays and more about how the team needs to evolve. It also suggests that investors assume key executives will remain on board - the bigger worry is whether they can stretch to the demands of the new strategy.

Looking beyond the first year, guests explored how leadership effectiveness drives value during the hold period.

“The importance of ongoing learning & development investments is crucial for leadership strength and resilience.”

Chief Executive Officer, Pharma

Value creation through talent management

Discussions highlighted the dual importance of introducing external talent and leveraging specialist expertise as engines for value creation. A strong case was made for hiring from outside traditional sector boundaries, while concurrently building capability within and nurturing resilience at every level. The exception to this rule typically related to Operational leadership in highly complex and regulated environments where sector experience is often required.

On-the-job learning and, crucially, the freedom to learn from mistakes, were underscored, as was the importance of structured onboarding and encouragement plans tailored for emerging leaders.

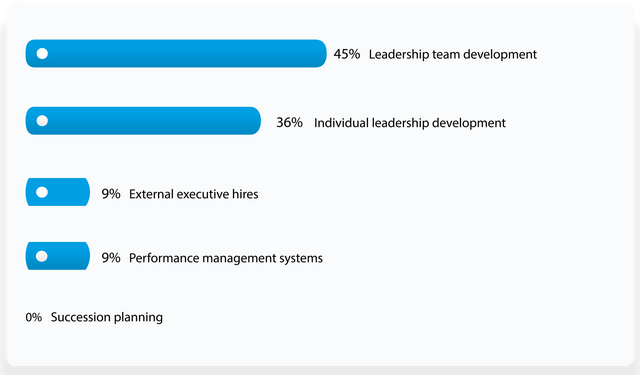

Poll insight:

Which talent management initiative most accelerates value creation?

Respondents see the fastest route to value not in hiring new leaders or adding processes, but in building the capability and cohesion of the existing team. This is a strong signal that investors believe potential already sits inside the organisation, but unlocking it requires deliberate development. Team effectiveness work and targeted individual development are seen as the most reliable accelerators of performance.

As the investment cycle approaches its conclusion, exit preparation emerged as a critical leadership test.

Leadership risks at exit: succession and alignment

Preparation for exit and clear communication surfaced as vital ingredients for sustained success. Succession planning, frequently overlooked, was recognised as critical to preserving momentum through periods of transition. Leadership alignment and honesty within the team were firmly prioritised, with several leaders noting that a lack of complete alignment would be reason enough not to proceed with a sale/purchase.

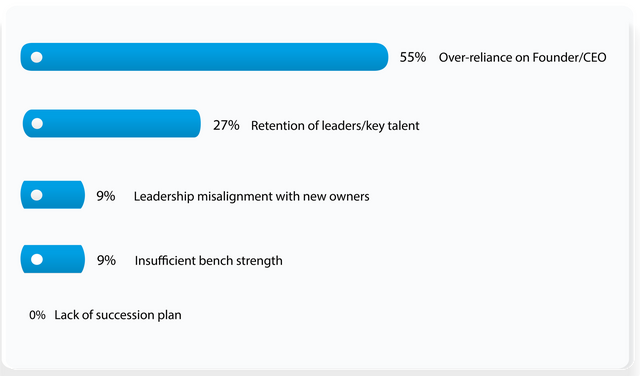

Poll insight:

What is the biggest leadership-related risk at exit?

“Key to keep operators engaged and maintain open communications through transition periods.”

Chairman, Healthcare

What stands out is the symmetry: the very issues that complicate the first year - alignment and behavioural capability - are also viewed as the biggest risks at exit. This suggests that leadership transformation is not a “quick fix” but a sustained thread throughout the ownership journey. If alignment and capability don’t shift meaningfully over time, the organisation risks carrying the same leadership liabilities all the way to market.

Conclusion

“Leadership Unlocked” brought into sharp focus a shared reality across the investment community: value creation depends on leadership that can adapt, align and accelerate performance throughout the entire investment cycle. The discussions underscored that while every organisation faces its own complexities, the core leadership challenges, readiness, alignment, capability and succession, are both universal and decisive.

The insights and polling data reinforced a clear message: leadership effectiveness is not a static attribute but an evolving requirement, shaping pre-deal confidence, post-acquisition momentum, mid-cycle value creation and, ultimately, exit readiness. Addressing these challenges early and deliberately is no longer optional; it is a fundamental lever of performance in private equity–backed businesses.

At Boyden, we are privileged to work alongside investors, operators and senior executives who recognise the strategic importance of leadership at every stage of the journey. Our work supporting leadership assessment, development and succession, across both executive and critical senior talent tiers, ensures clients have the insight, alignment and capability needed to deliver sustained value.

We remain committed to providing a trusted space for honest dialogue and actionable insight, and to partnering with organisations as they navigate the increasing demands placed on today’s leaders.

If you would like to discuss how we can support you through interim management, executive search or leadership consulting, please get in touch.