Articles & Papers

All Aboard: The changing board of directors

Examining the driving forces behind the evolving role of boards, how stakeholders perceive and evaluate board performance, and offering valuable guidance on cultivating stronger, more resilient boardrooms. Part one of a three-part series.

Change is afoot within Canadian boardrooms. Faced with unique challenges spanning the economic and civil society landscapes, boards are actively reassessing what it means to govern while continuing to execute on their objectives. What are the intricacies of this dynamic shift? How are organizations forging a path towards enhanced governance excellence? What are the common threads among diverse accomplishments? Through research, reflection and conversations facilitated by Boyden's Jonathan Finless with some of Canada's leading board directors, we learn that while successful performance differs, the recipe for results is often the same: great purpose, serious process and outstanding people.

In this three-part series, we examine the driving forces behind the evolving role of boards, explore how stakeholders view and evaluate board performance, and offer valuable guidance on cultivating stronger, more resilient boardrooms.

In Part I, we feature commentary from Carol Stephenson, Corporate Director & former Dean of Ivey Business School, and Irene Britt, Board Director, Victoria’s Secret.

Part 1: The changing board of directors

Essential Observations

- Boards are transitioning from being fiduciary stewards to strategic conduits, playing a critical role in shaping corporate vision and driving value creation.

- Propelled by globalization, technology and social change, expectations of boards are rising. Stakeholders are demanding deeper value-add from the board and its directors. This is influencing board recruitment and board refreshment across Canadian corporate boards.

- Directors acknowledge the importance of diverse perspectives while growing increasingly concerned about performance and composition. Nine out of ten directors thought at least one person on their board should be replaced.

- Highly dynamic and performance-oriented boards, characterized by their strategic prowess and ability to support management’s execution, are emerging as winners.

- Akin to elite sports teams, great boards prioritize talent. They ensure they have the right mix of people around the table, supported by thoughtful nomination processes that eye director caliber and character.

The Board of Directors has been where the governance buck stops with Canadian organizations for hundreds of years. Individual directors, whose appointments typically recognize eminence and the culmination of a successful career, enjoy national prestige within Canada’s tightknit corporate community. Accordingly, nomination to these vaunted seats – and the compensation that can accompany – is highly aspirational for most corporate executives.

Notwithstanding, the role of the corporate board has historically been limited by design, relegated largely to the attenuation of risk. At their best, boards have selected and directed strong CEOs, challenged the strategic imperatives, and provided prudent oversight. At their worst, they are symbolic, hapless and providing air cover to domineering executives. Relative to management, board performance has been overshadowed, seldom scrutinized and rarely considered to be an active driver of organizational success.

“Great leaders and talented executives are not automatically the best board members. It comes down to fit.”

Carol Stephenson

Corporate Director & former Dean of Ivey Business School

The Winds of Change

The role of the board is in flux. As corporations contend with the global pace and magnitude of change, stakeholder expectations are rising, demanding a deeper value-add from the governance function. Boards are increasingly visible and their failures well chronicled. The recent lapses in governance at Silicon Valley Bank and FTX are the latest chapter in a familiar narrative that includes Nortel, Enron and Blockbuster.

Meanwhile, Canadian civil society has demanded that corporate tone and attitude undergo a paradigm shift. In recent decades, as our corporations become more institutional, they’ve been accompanied by a parallel rise in market expectations, sometimes referred to as stakeholder capitalism. Canadians are increasingly looking towards the private sector for leadership, guidance and financial support on a host of important issues ranging from globalization and emerging technology to social justice and climate change.

These expectations have thrust boards into the spotlight. Large institutional investors and asset managers like BlackRock, led by Larry Fink, are driving the push for companies to take more action on issues such as climate change. On representation and diversity, Canadian issuers now must legally disclose the diversity of its board and senior management teams on several dimensions, and meet targets designed to promote parity.

There is ongoing debate about the societal and performance merits of stakeholder capitalism. That said, it’s meaningfully influencing director recruitment. Large proxy advisory firms like Institutional Shareholder Services (ISS) and Glass Lewis are regularly updating their voting guidance. As of this writing, shareholders of many Canadian corporations are now being urged to replace the Chair of a Nominating and Governance committee where less than 30% of directors are women.

Women now represent 26% of Canadian corporate directorships, up 2.2% year over year. As of 2022, members of equity seeking groups represented roughly 1 in 10 corporate directorships, a 37% rise year over year. Board seats held by indigenous directors doubled. While it may fall short of some stakeholders’ expectations, it reflects a swift and concerted response and represents corporate Canada’s most serious progress to date on board refreshment.

These are welcome changes. The social objectives are worthy and appear well supported by stakeholders. But how has this realignment played out practically? A recent survey of over 600 public company C-suite executives underscores much progress, while also capturing sentiments which gives pause.

Board members overwhelmingly embrace diverse perspectives around their boardroom tables. Unsurprisingly, they value the potential for these perspectives to sharpen company strategy and improve key shareholder and stakeholder relationships. Yet, it also revealed majority of directors remain unsatisfied with their Board’s current composition. Today, 89% of executives say one or more directors on their board should be replaced.

What’s more, while Boards do purport to be in favor of director refreshment, many disagree on the mechanics. Where not already in place or mandated, many directors have expressed some resistance to mandatory term limits or retirement ages.

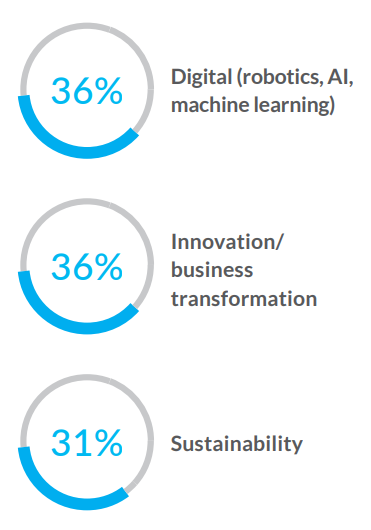

Based on Boyden's proprietary research, when asked to emphasize competencies they felt were important on their board, those surveyed cited digital, innovation/business transformation, and sustainability in the top three, while technology/cloud, risk/legal/compliance and cybersecurity ranked near the bottom. Meanwhile, board respondents noted rising business costs and succession planning as top internal risk concerns. This suggests boards are not making the correlation between who and why.

Carol Stephenson is an accomplished Canadian executive, board director and the former Dean of Ivey Business School. She highlights how boardrooms are spending more time than ever on talent and recruitment: “Great leaders and talented executives are not automatically the best board members. It comes down to fit.”

A Shift to Performance

Less discussed in the din around governance, are a quiet but growing cohort of highly dynamic boards. Laser focused on statutory matters, but also on performance and execution, a new breed of board is emerging. They govern above and beyond earnings per share or pedestrian risk management. Alongside management, these boards are ushering in a new era of value creation. They are more knowledgeable about their businesses and sectors, strategically savvy and as competitive as the management teams they govern. One CEO leading a large Canadian technology company echoed this view succinctly: “I need a board that can help me, not slow me down”.

“Boards [have always] prioritized total shareholder return (TSR). However, Boards today have expanded the conversation beyond conventional metrics to identify the other factors that drive TSR, including talent, strategy and risk. All of these are in the interest of shareholders.”

Irene Britt

Board Director, Victoria’s Secret

A governing board that’s distinct from management first appeared in Elizabethan England. Structurally, little has changed in nearly 500 years. A board is still typically made up of a mix of directors, some with vested interests and some deemed independent. Directors are appointed through a variety of mechanisms, and they work at-large and in various committees with largely similar terms of reference regardless of industry or sector.

By contrast, the functional mandate of the board has evolved dramatically. Spurred by the breathtaking pace of innovation and global competition over the last 50 years, boards have graduated from being fiduciary stewards to strategic conduits. Today, boardrooms are serious sanctums for corporate vision.

Irene Britt is an accomplished corporate leader and independent director for several boards, including Amica and Victoria’s Secret. She underscores the evolved view boards have taken towards value creation: “Boards [have always] prioritized total shareholder return (TSR). However, Boards today have expanded the conversation beyond conventional metrics to identify the other factors that drive TSR, including talent, strategy and risk. All of these are in the interest of shareholders.”

There is a shrinking margin for error around board composition. Like elite sports teams, winning organizations need a deep cast of top performers in the arena and on the bench. Unsurprisingly, this where best-in-breed boards separate themselves from the pack. Engrossed with their nomination processes, they are dogged about ensuring they have the right people at the table.

Final Thoughts

What’s clear – the task for today’s nominating committees is more complicated than ever. While the markets, regulators and society at large send evolving instructions about board composition, strong boards will continue to be defined by thoughtful, proactive nomination processes which prioritize director caliber and character while managing an evolving diversity matrix.

In this series, as Boyden continues this discussion with leading directors, we examine the shift towards board performance in greater depth and lay a roadmap to attract great directors and build better boards.