Case Study

Speedy CFO+ Hiring Decision Support

Alpine One, Boyden Germany's leadership consulting partner, assisted a European investment company in swiftly selecting a CFO+ candidate for one of its portfolio companies through a rigorous assessment process involving psychometric tests, structured interviews, and case studies, ensuring the candidate's readiness and cultural fit.

The Client

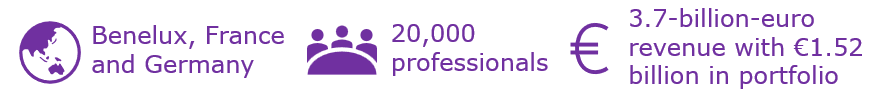

Our client, a leading full-service provider for the expansion and maintenance of pipeline construction and cable laying networks, belongs to a European investment company listed on Euronext Brussels. As a recognized leader in private equity with 40 years of experience, the portfolio includes around 60 portfolio companies across five investment platforms: consumer, healthcare, life sciences, smart industries, and sustainable cities.

The Challenges

Alpine One was approached by Boyden Interim Partner, York von Massenbach, to support his client. The client aimed to make a hiring decision within 5 days for a CFO+ role (CFO who, in addition to the traditional CFO role is responsible for tasks such as transformation, IT, COO functions and strategy) for one of PE’s investment platform companies. They wanted to validate the gut feeling that emerged during the initial interview rounds through an impartial party. Besides assessing the candidate's suitability for the role, it was crucial to determine if the candidate could assume the role from day one with minimal support and onboarding, as well as establish a connection with the employees of the portfolio companies.

The Approach

The process was initiated with a psychometric test (Hogan assessment) and the analysis of the results as step 1. Blind spots concerning the role were identified, which were validated in step 3 by conducting a structured interview. Simultaneously, the client was interviewed regarding expectations and focus areas as step 2. After the first two steps were completed, case studies for the assessment interview (e.g. strategy and conflict scenarios) were designed and aligned with the role, the industry, and the portfolio companies.

The core component of the assessment was as step 3 a 4-hour transparent and appreciative interview. During the assessment, meaningful professional situations and challenges were systematically and structurally evaluated in terms of strengths, weaknesses, potential, and risks. The candidate was interviewed by the two managing partners from Alpine One who alternated roles, depending on the interview situations, either as interviewer or observer to ensure neutrality at each step of the assessment process. The process was concluded with step 4, the validation, analysis, and dossier compilation. To validate the accuracy of the assessment from the interview and obtain information, the interview was subsequently analyzed in detail. The analysis validated the interviewers' assessments and generated a comprehensive documentation of the evaluation. It provided a link between the data material and the evaluation.

Exceptionally swift, outstanding, and precise.

Partner Investment Company & Board of Director Portfolio Company

The Result

The results from the psychometric test and the structured interview were consolidated and compiled into a strengths-weaknesses analysis, personal dynamics including opportunities and risk analysis, presented as a dossier. In addition to the individual dossiers the readiness and cultural fit was assessed. This helped the client to gain a meaningful insight into the candidate's abilitieses and potential from an external perspective.