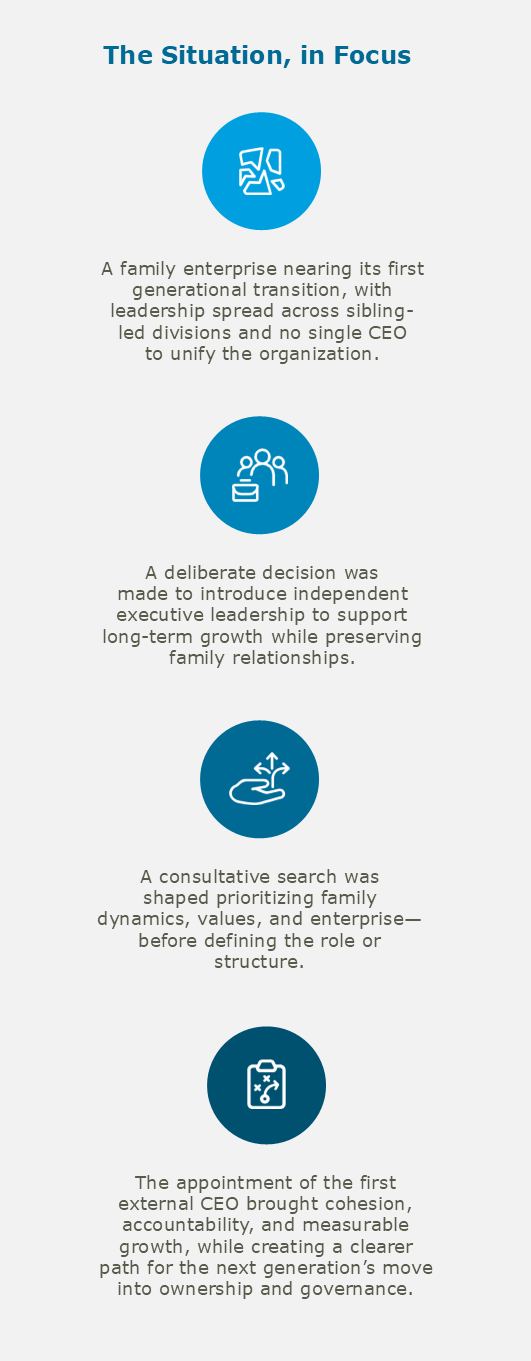

A First Generational Turning Point

Every family business reaches a point, or a series of points if they’re fortunate, where the responsibilities of leadership must be handed down to the next generation. Inevitably, this stage of maturity demands difficult decisions to ensure that both the company and the family itself can flourish.

For a family-owned business approaching its first generational succession, these decisions were especially fraught. Founded by a husband‑and‑wife team in Canada, the company had grown into a diversified $300 million portfolio spanning North America. After her husband’s passing, the matriarch became the backbone of the business, demonstrating skill in finance and in managing her three adult children, all working in the company. Having built an empire, she was ready to retire.

Bridging the Leadership Gap

In the absence of a unifying CEO, leadership had become fragmented across several silos, with each sibling focusing on their own division. A third generation waited in the wings without a succession plan or clear management structure. The enterprise was stable, but its potential went unrealized, internal conflict simmered, and with no independent directors on the board, decision-making was mired in family issues.

The family brought in a family governance consultant to advise on organizational structure, the shareholders’ agreement, and other matters. Recognizing the leadership gap and its mounting adverse effects, he persuaded them to consider hiring an outside CEO, and with their consent, reached out to Boyden.

The Boyden partner demonstrated deep understanding and expertise in working with family-owned businesses. He assured them that he would find a CEO who could deliver transgenerational growth and serve as a custodian of the family’s wealth. But equal to, if not more important than delivering growth, his foremost priority would be preserving family harmony. They knew they had found the right person to guide them, and elected to work with Boyden.

An Unconventional Search for an Uncommon Leader

Ceding control and entrusting the family’s wealth and legacy to a non‑family member meant overcoming significant emotional and cultural hurdles. The Boyden partner’s experience and instinct told him that the circumstances demanded a consultative approach. He enabled this process by forming genuine relationships with the family, ultimately earning their trust.

The circumstances also called for an unconventional search, guided by the qualities of the individual required, not a pre-defined job description. The role required qualifications and personality traits so specific that the candidate profile was paramount. The job description could be developed later, with the new CEO’s input.

Beyond understanding the company’s primary industries, the CEO would need experience in a structured, metrics‑driven enterprise shaped by formal processes and best practices. Experience in a family business was equally important. Success would hinge on the ability to navigate complex family dynamics, remain flexible, and know when to stand firm and when to yield. Finance expertise and North America-wide experience were also among the criteria. This level of specificity required extensive research, dialogue, and understanding of interpersonal nuances to identify and develop candidates.

When approaching the shortlist of candidates, the intention was not to downplay the job's challenges. The right candidate would understand them and know how to navigate the informal hierarchies that often govern family businesses. This meant leading with the complications, rather than selling the opportunity.

To ensure transparency, it was essential to keep the three siblings personally involved throughout the process. An interview guide and situation‑based themes were developed to facilitate group and individual interviews, giving a sense of what it would be like to work with the candidate. Each sibling met one‑on‑one with the finalist. Ultimately, the decision was unanimous.

A New CEO Ushers in a New Era

The chosen CEO had all of the requisite background, from the most fundamental—experience in a family business—to CPA credentials. As he assumed the role and began to co-create it with the family and Boyden in a leadership consulting capacity, the accuracy of the carefully crafted profile was validated.

The family did not have a specific growth target. They only knew they wanted to grow, and when the time came, transfer the business to their children. The new CEO recognized the need for a plan and identified strategic growth opportunities, knowing when and where to pivot the company in line with market trends. He also ensured it was in safer markets through the COVID era. Drawing on his enterprise background, he introduced standard processes, documented workflows, and implemented an ERP.

Driven by long-term vision, the CEO also served as a mentor to the third generation and created a framework for fair evaluations and promotions. As part of a broader effort to centralize the leadership structure and build a more independent C-suite, he laid the groundwork for shifting the second generation from operating roles to board and ownership roles.

The CEO has exceeded all expectations. Within four years, the company grew by approximately 35%. To manage this growth, he hired a CFO. The family continues to work with Boyden for leadership consulting and team development, and has since hired a COO and a CHRO.

This engagement was led by Jim Harmon, Managing Partner, Boyden Canada.