This article was originally published on Bloomberg.com. Click here to view the original article.

If money talks, Starbucks Corp. CEO Kevin Johnson is about to get an earful.

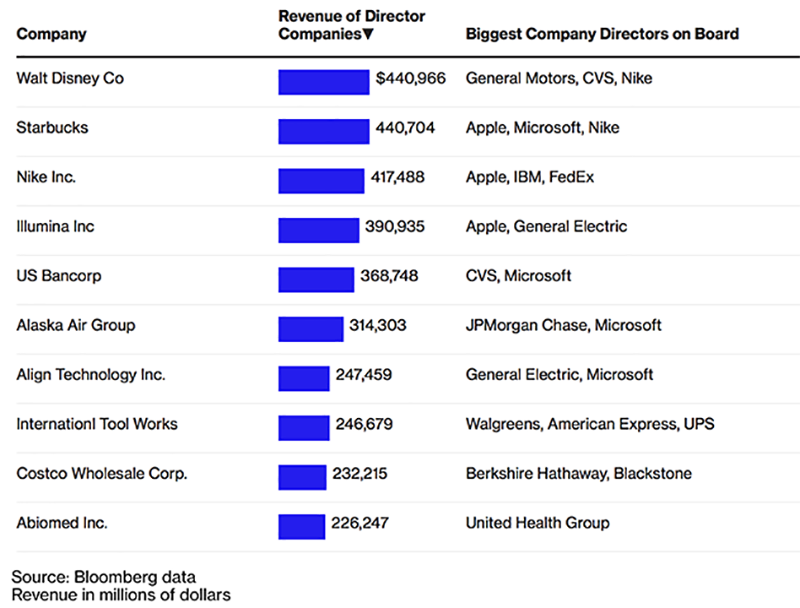

When the coffee chain’s expanded board meets for the first time later this year with new members from Apple Inc., Nike Inc. and Domino’s Pizza Inc., the 13 executives around the table will represent public companies with $440 billion in combined revenue. Walt Disney Co. is the only other U.S. company with similar heft in the board room.

“If you’re at a high-rep, high-prestige company, you want to go on a similar board,” said David Larcker, a professor at the Stanford Graduate School of Business. “What that looks like changes over time.”

Fifty years ago, those prestigious board seats were at companies such as IBM or U.S. Steel Corp.. Executives crowded Jack Welch’s meeting rooms in the 1980s. In the 1990s there was Yahoo Inc., AOL, and other dot-coms. The Procter & Gamble Co. board was overflowing with CEOs well into this century.

Following the revelation of widespread fraud at Enron, once a hot board in its own right, the Sarbanes-Oxley Act placed greater oversight responsibility on corporate directors. Today, a working executive can only realistically serve on one or maybe two outside boards, Larcker said.

Big Money Boards

Directors from the largest companies can influence boardroom firepower