Written by Jeff Green. This article was originally published by Bloomberg. Click here to view the original article.

➤ Female directors improved slightly to 31.3% of seats in April

➤ Women held 8 more seats as appointments edged out departures

The so-called Great Resignation isn’t just draining bodies from the blue- and white-collar rank-and-file, it’s also part of the challenge for women seeking to reach parity in S&P 500 boardrooms.

Women gained eight seats on S&P 500 boards in April, as 17 companies added women and 11 companies saw women retire, resign or die, data compiled by Bloomberg show. In 2021, a record 48 million people quit their jobs, according to the US Bureau of Labor Statistics -- which became know as the Great Resignation or the Big Quit. In March, 4.5 million people left their jobs, a monthly record.

“The Great Resignation isn’t limited to just front-line workers or executives,” said Alicia Hasell, managing partner at executive recruiter Boyden. “We’re seeing board members as well who are leaving those roles to pursue altruistic or philanthropic initiatives.”

Many companies are adjusting their boards as they enter this year’s proxy season, when directors either stand for re-election or opt to leave. Even as companies -- under pressure from investors, employees and regulators -- add more women and people of color to their boards, it’s inevitable that others will leave, slowing overall gains.

Bank of America Corp., Morgan Stanley and Citigroup Inc. were among companies with women who left the board in April, while Dow Inc., Hasbro Inc. and Visa Inc. were among those that added female directors. The overall number of women on bank boards was unchanged last month.

Read more: Women on S&P 500 Bank Boards Enter Third Month with No Gains

“Many of the groundbreakers, the first women to join boards, are just now coming off boards,” said Julie Daum, who leads the North American board practice at recruiter Spencer Stuart. But the overall share for women should still improve because there are likely more men reaching retirement age than women because fewer women who are 75 years old had opportunities to serve on boards, she said.

As so many boards still only have one or two women, a departure may mean a company is back to starting from scratch, said Jane Stevenson, vice chair at recruiter Korn Ferry. Until boards reach parity, or better, even small changes will have a large impact, she said. And with the demand, women and people of color have many options.

The bright spot is that last year 45% of new directors were women and 41% were members of under-represented groups at Fortune 500 companies, which means the pipeline is improving, said Sachi Vora, a partner at recruiter Heidrick & Struggles. Also, boards at companies nearing an initial public offering and those controlled by private equity are also diversifying, which will eventually improve the makeup of public boards, she said.

Add the growing diversity of private company boards to the trend of public companies seeking outside board roles for rising female executives, and there are many reasons to think the pace will improve in the future, Vora said.

The average number of female directors in the S&P 500 was unchanged at 3.5, out of an average board size of 11.2.

- The percentage of female directorships increased to 31.3% from 31%.

- That’s below the 34.7% of women on boards of the S&P/ASX 200 in Australia and 38.5% of the Stoxx 600 in Europe.

- Seventeen S&P 500 companies increased the number of women on their boards; the top companies by market capitalization were Visa, Wells Fargo & Co. and Activision Blizzard Inc.

- Eleven companies reduced the number of female directors; the top companies by market value were Bank of America, Morgan Stanley and Citigroup.

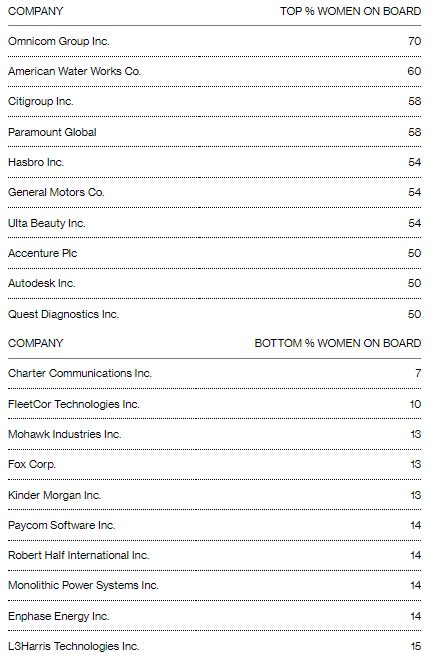

- Omnicom Group Inc. has the highest percentage of women on its board.

- Charter Communications Inc. has the lowest percentage of women on its board.

- The communication services sector led the net gain in female board members, with two women added to the board at Warner Bros. Discovery Inc.

- Health care notched a net decline of two female directors, with Humana Inc. and Centene Corp. losing female board members

- Visa, Oracle Corp. and Medtronic Plc are among companies that surpassed 30% female board membership for the first time since at least January 2019. The number of S&P 500 companies above this key threshold rose to 286 in April from 283 the previous month.

- The Bloomberg Gender-Equality Index dropped 6.6% in April, outperforming the MSCI World Index, which fell 8.3%.

- The Bloomberg Gender-Equality Index is a modified capitalization-weighted index that tracks the financial performance of those companies committed to supporting gender equality through policy development, representation and transparency.

S&P 500 companies with the highest and lowest percentage of female board members: