Opportunity: global recalibration, idiosyncratic deals, power shifting East

Politico-economic change in the United States, Europe, Asia and the Middle East is driving a shift in portfolio construction, with GPs recalibrating global strategies, notably geographic diversification. We see them leaning into more idiosyncratic opportunities, and addressing demographic changes: baby boomer retirement impacting the economy and social security in the US; aging populations straining social security and healthcare in Europe; and growth of the middle class in Asia shifting global economic power to the East. In the Middle East, family businesses are partnering with private equity to fund growth, ESG-focused investment is gaining traction, as well as co-investment between sovereign wealth funds and GPs.

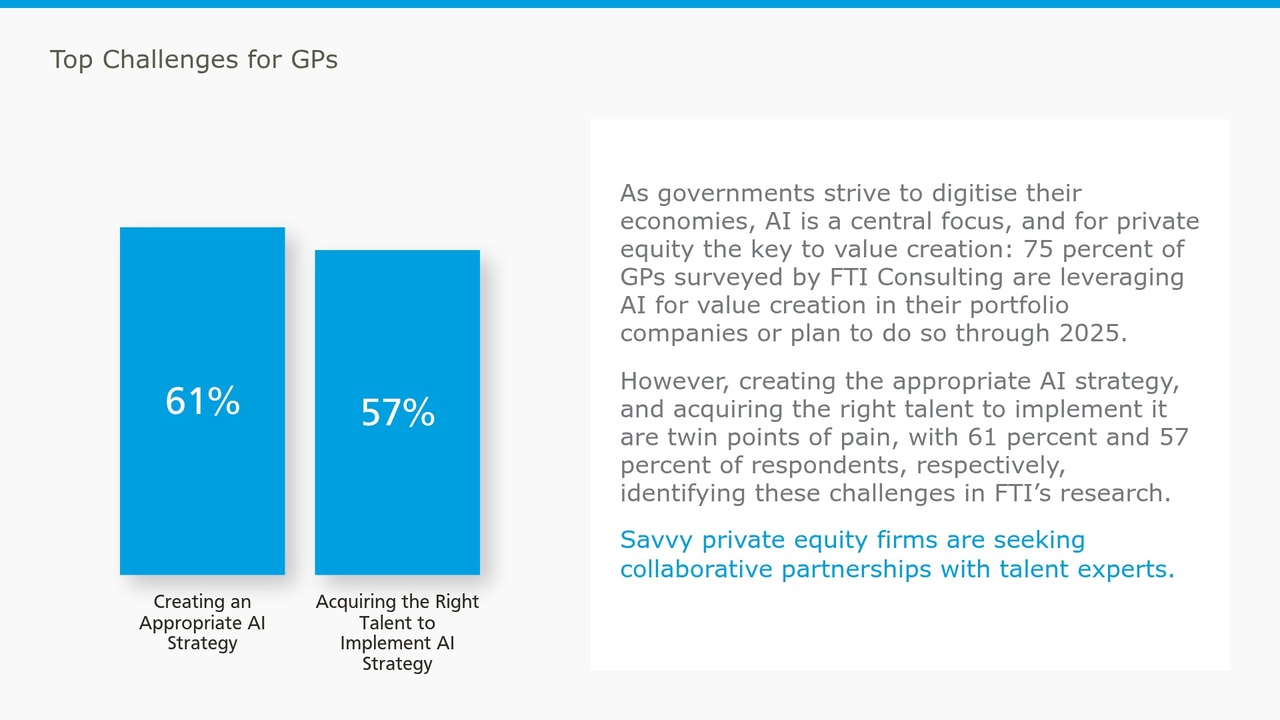

Emerging opportunities abound to provide capital and leadership to support socio-economic change driven by government policy, primarily centred around digitising the economy through advanced AI and quantum technologies, infrastructure and renewable energy.

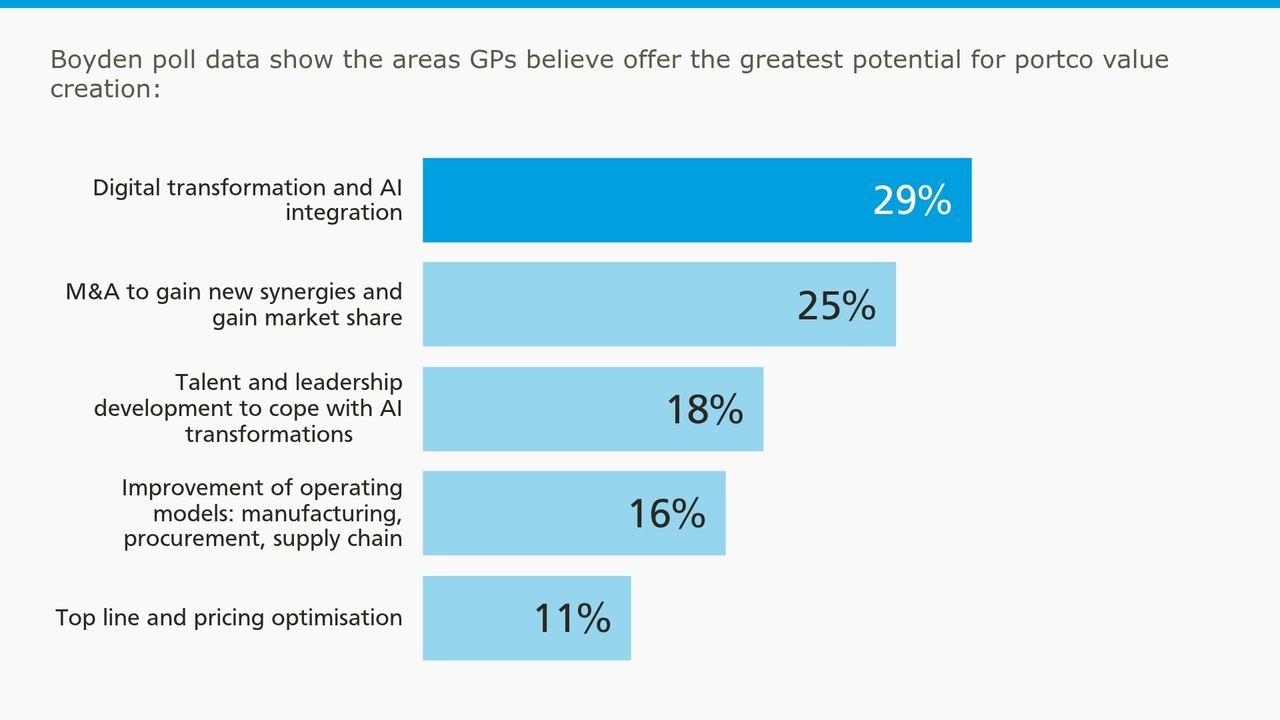

Boyden poll data corroborates this: ‘sectoral concentration in resilient areas (AI, healthcare, energy, infrastructure)’ is the top strategic adjustment most commonly made among GPs navigating an unstable environment.

“These changes require leaders with specific technical, collaborative and influential skills to harness new dynamics in transforming industries,” comments Kathy Patillo, Managing Partner, United States, and Global Leader, Financial Officers Practice, at Boyden. “Unique opportunities demand unique talent, and we are identifying exceptional talent pools globally for private equity firms and portfolio companies.”

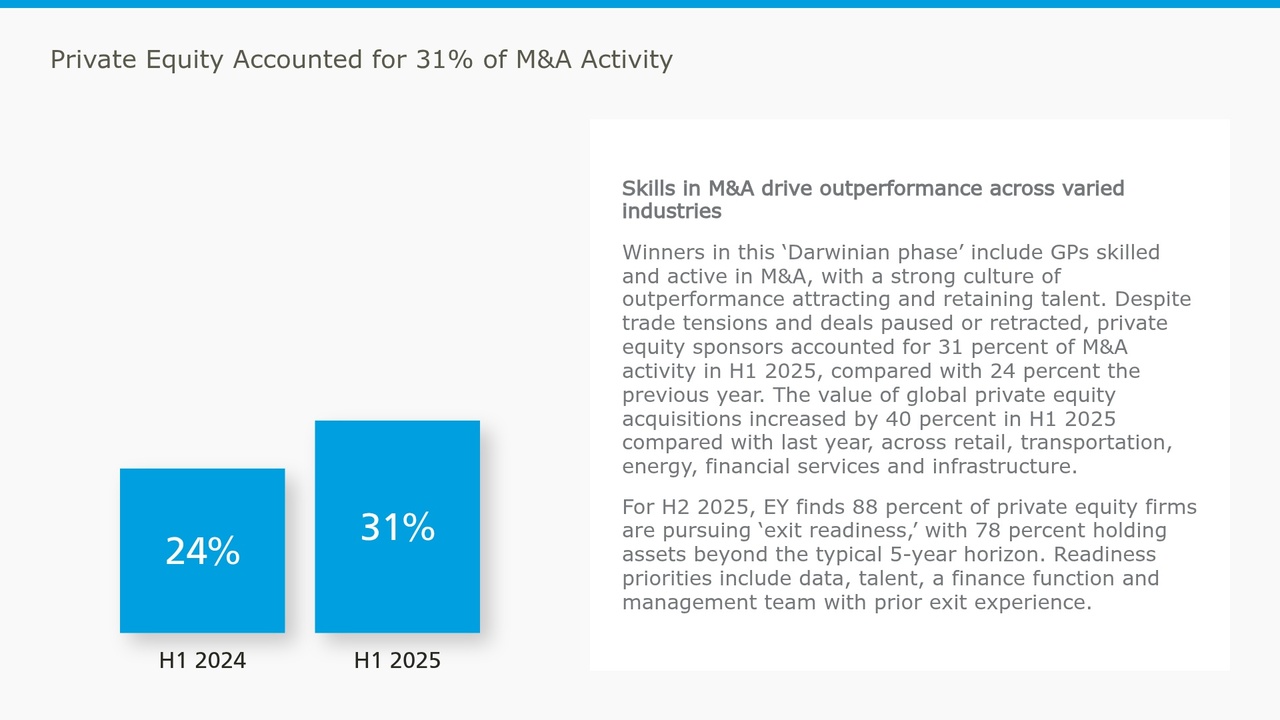

Through ‘investor governance'1 and active ownership models, private equity is enlivening today’s most notable opportunities in terms of both capital and talent.

Defensive moves: semi-liquid structures, evergreen and continuation funds

With GPs maintaining investments over longer time periods, defensive moves include addressing liquidity through the secondary market, semi-liquid structures, evergreen funds and GP-led secondaries such as continuation funds. Valerie Baudson, CEO of Amundi comments, “[Given] performance, transparency, liquidity, vision... secondaries is, for me, one of the most interesting asset classes, or expertise, in the private asset area today”.

Boyden poll data reveal: ‘continuation and evergreen funds’ are the second most common strategic adjustment to market conditions among private equity firms.

Other approaches: targeting private wealth, and co-investment strategies

In a major shift, GPs are leveraging semi-liquid or evergreen funds to broaden beyond institutional LPs and attract retail investors keen to diversify, particularly given stock market volatility and private equity’s comparatively higher returns.

In addition, LPs seeking a more proactive role in the pace and scale of investment are attracted by co-investment and direct deals. For GPs, co-investments solve longer fundraising cycles, with a record $33.2 billion in global capital raised in 20242. Bigger deals may also spur GPs to offer co-investments to all their LPs; 2025 is on track to be the strongest year for large deals by volume since 2021, making it potentially the second strongest year in history for large deals3.

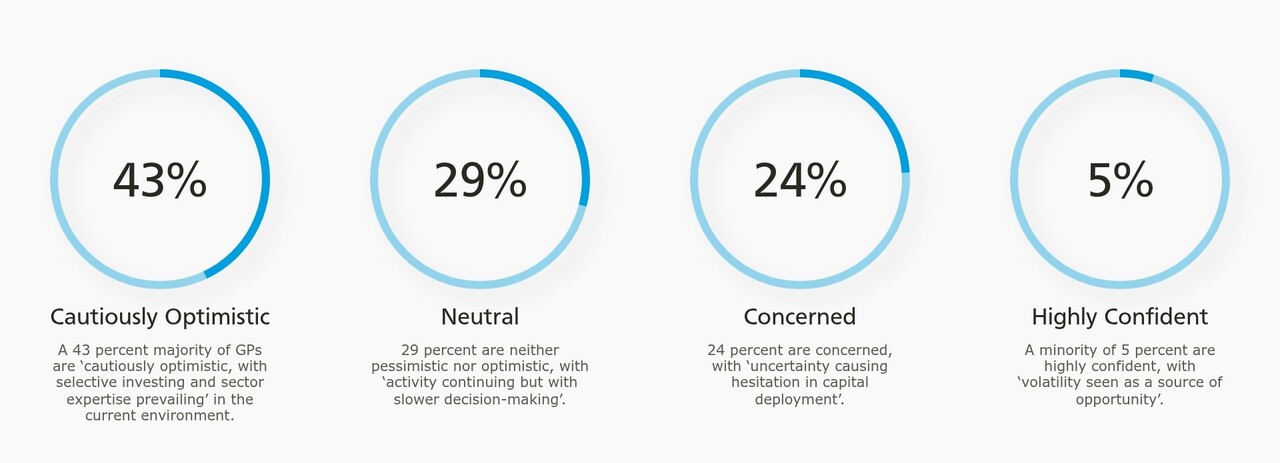

Uncertainty: more opportunity if you can spot it, better results if you have the talent

Today’s environment plays to private equity’s strengths. The most successful GPs are highly skilled at spotting opportunity in an uncertain, complex and evolving climate, planning and working to the longer term.

In the current market, size matters, reducing perceived risk. While annual increases in fundraising slowed in 20244, very large GPs had fewer problems raising capital, with the biggest attracting the greatest share of funds raised: the top three (KKR,EQT and Blackstone) each raised almost $100 billion and above, while the top 10 each attracted nearly $50 billion and above5.

Lionel Assant, Co-Chief Investment Officer, Blackstone says, “Moments of distress or uncertainty present more opportunities than challenges”. Just like wealth managers, PE experts have to ignore the “noise of volatility” and leverage their natural advantage of long-term investing without the pressure of quarterly reporting.

According to IPEM’s Daily Spin6, deals completed during high policy uncertainty have historically delivered better results, up to a 10 percent difference in annual alpha, compared with deals in periods of less uncertainty. Performance data show that GPs able to arbitrage economic policy uncertainty pursue sharper strategies, new investor bases and innovative financing models. They also benefit from fewer competitors, lower valuations and a long-term focus in periods of uncertainty.