Agri-food tech: a broad sector with opportunity across the value chain

- PE and VC firms are investing in food and agriculture for several reasons, most obviously the increased demand for food. The UN forecasts the global population to reach 9.3 billion by 2050; food production would need to increase by 50 to 60 percent.

- Agri-food tech is a broad sector with a multiplicity of opportunity. As population growth, food security, ESG and consumer preferences spur innovation, investors can profit along the value chain, while injecting environmental stewardship.

- Inflationary shocks and supply chain issues have highlighted food security, creating opportunity for investors to get involved in agri-tech to solve these challenges

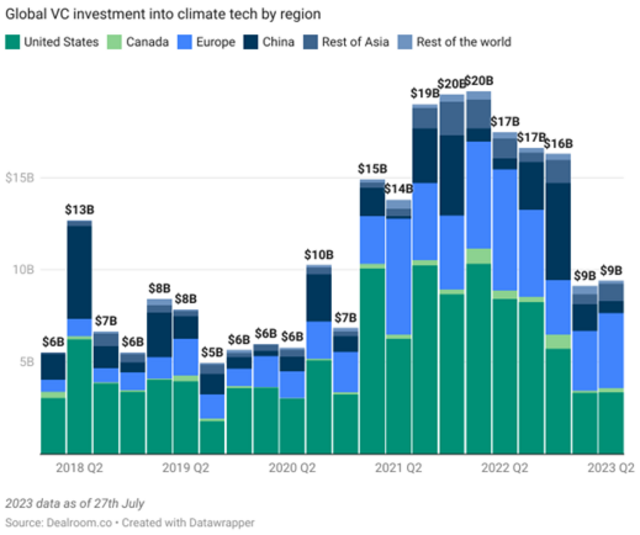

- ESG factors and climate change have also driven significant investor interest in sustainable agriculture. In 2019, global agri-food systems accounted for just under a third of human-led greenhouse gas emissions, making them a key target for climate-related action, including regulatory regimes imposed by food law.

- While foodtech is one of the main VC funding segments, attracting $30bn in 2022, it experienced a stronger slowdown than many other sectors; late stage and breakout stages primarily accounted for a 70 percent drop in Q1 2023 vs. Q1 2021, with early stage showing more resilience. In H1 2023 it ranked in the top six in funding, attracting $7bn from VCs.

- In Q1 2023 PE firms invested nearly $10 billion in agriculture, a more than 2.6x increase since Q1 2013. A key benefit for recipients is the pursuit of ESG practices at a scale that would be unaffordable through more traditional forms of finance.

- As the sector evolves, business models are under scrutiny, with expectations of consolidation and increased M&A. Investors are also attracted by diversification: investing in agricultural sectors reduces overall risk because they are less correlated to other asset classes.

- Geographic differences also provide varied opportunities. Israel is a food and agtech powerhouse, with early innovation in data-enabled tech and IoT to address a shortage of natural resources. On the other hand, large territories such as China and Brazil are ripe for the development of new technologies.

- Government and fiscal incentives are also driving developments, for example in the United Arab Emirates. Abu Dhabi is striving to become a global centre for agricultural innovation, leveraging this to secure strategic investment, solve food security and further develop a knowledge economy.

- Read more on the topic:

McKinsey: Building food and agriculture businesses for a green future

Taylor Wessing: Value of food-tech and ag-tech

Vision magazine: PE’s role in transforming agriculture

Dealroom: Foodtech guide

"With PE and VC firms investing to meet the rising demand for food due to population growth, talent is vital across the entire value chain. Leaders capable of navigating innovation spurred by food security, ESG, and shifting consumer preferences are instrumental. Moreover, as government incentives drive developments, executives adept at aligning strategies with global initiatives, such as Abu Dhabi's pursuit of agricultural innovation, become crucial for organizations looking to secure strategic investments and foster a knowledge economy."

- Pierre Fouques Duparc

Managing Partner, France