In the first Boyden Brief installment of 2024, the UK interim management team discussed the private equity (PE) market continuing its trajectory of resilience and adaptation, although it may be another year of navigating evolving economic conditions and shifting investor priorities.

It will not come as a surprise to anyone that 2023 was a volatile and somewhat flat market for Private Equity (PE). Starting with the obvious: continuing economic headwinds, soaring inflation and interest rates made it challenging to unlock liquidity and raise funds. This was layered with an ever-increasing value gap between what companies valued themselves at and what investors were willing to pay.

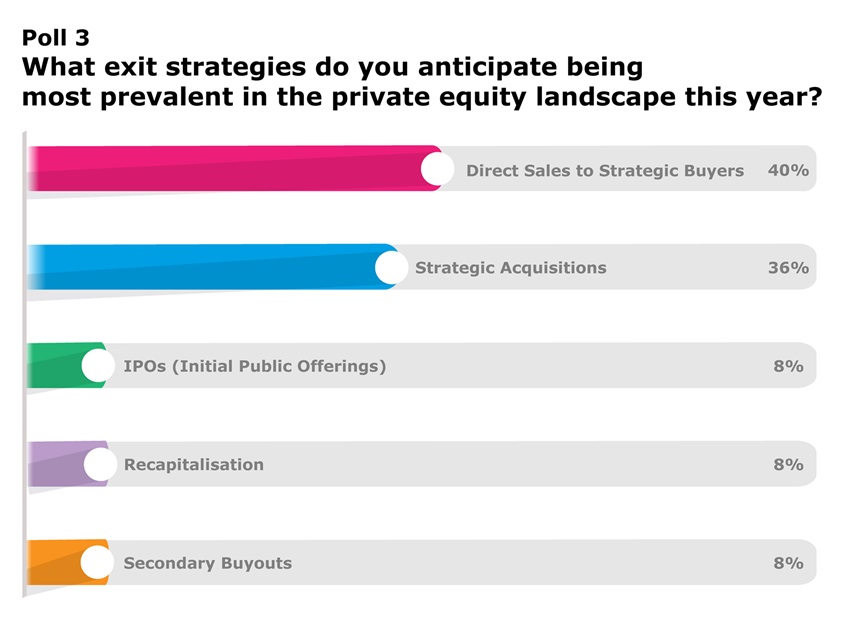

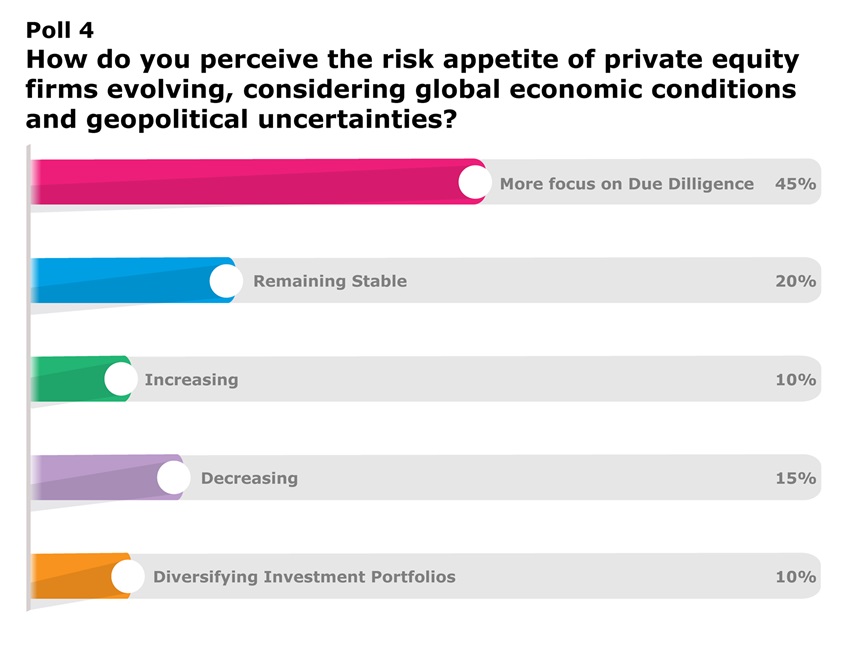

Our predictions going into 2024 were that we would not see a “hockey-stick” moment from the outset, although we expected activity to increase towards the back end of Q1, going into Q2. We also envisaged an increase in activity through carve-outs, value-creation of existing portfolio companies, increased pre-deal due diligence and publicly listed companies being taken private.

As we approach the end of Q1, hugely positive signs are evidenced through a flurry of activity in February, although we are not being complacent. As our interim management community is a hugely important network for Boyden, we wanted the first Boyden Brief of 2024 to be focused on the Private Equity market and future trends.

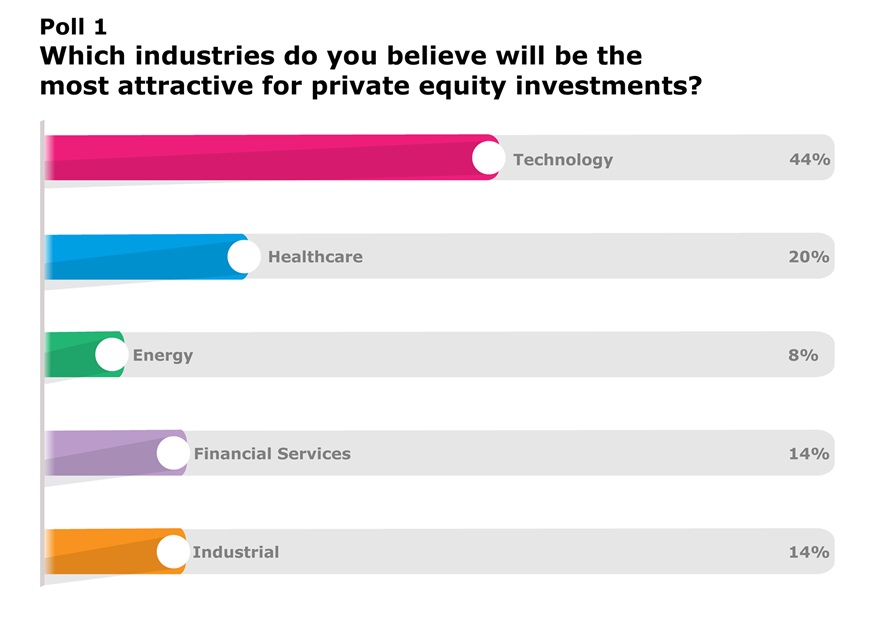

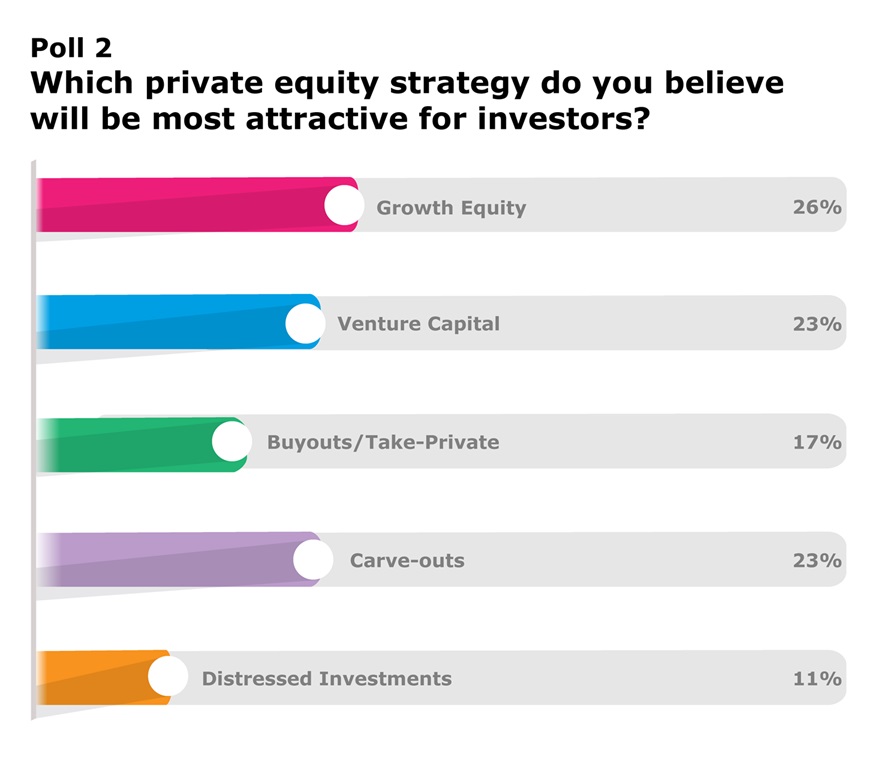

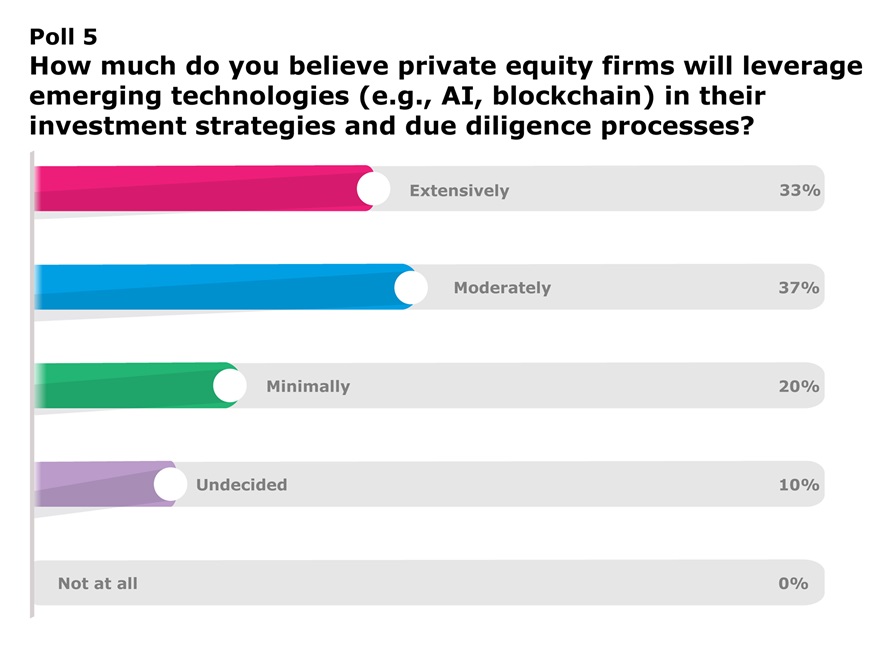

As is tradition with the Boyden Brief, we posed various poll questions to the interim management community with an emphasis on looking ahead to this year, relevant to the PE market.