The PROPHET/Boyden Insights Series are brief articles providing an understanding on leadership roles and executive team dynamics. The insights are based on the leadership styles of 10,000 executives and more than 2,500 C-suite leaders, representing organizations worldwide of different sizes, across all sectors. Each article provides statistically significant patterns of behavior; explains the business implications and offers advice for optimizing collective performance. In this third article, we review how the decision-making preferences of CFOs are the most different in the C-suite.

CFOs are the most likely to prioritize ‘taking an analytical approach’ and the least likely to spend time ‘influencing others’

In common with C-suite colleagues, the majority of CFOs indicate a strong preference for Driving - they are likely to be goal-oriented, direct and assertive. However, two attributes distinguish them: they are the most motivated by ‘analytical decision-making’; and the least motivated by ‘influencing colleagues’.

In analytical decision-making, CFOs are likely to take a more rational, data-driven approach; they prefer to gather information, think through problems, model outcomes and analyze ideas to determine the best solution.

CFOs are the least motivated by influencing colleagues, convincing and persuading others. They are more likely to regard a well-considered proposal as sufficient rationale for decision-making, without needing to galvanize others to generate energy and enthusiasm.

The typical PROPHET Profile of CFOs

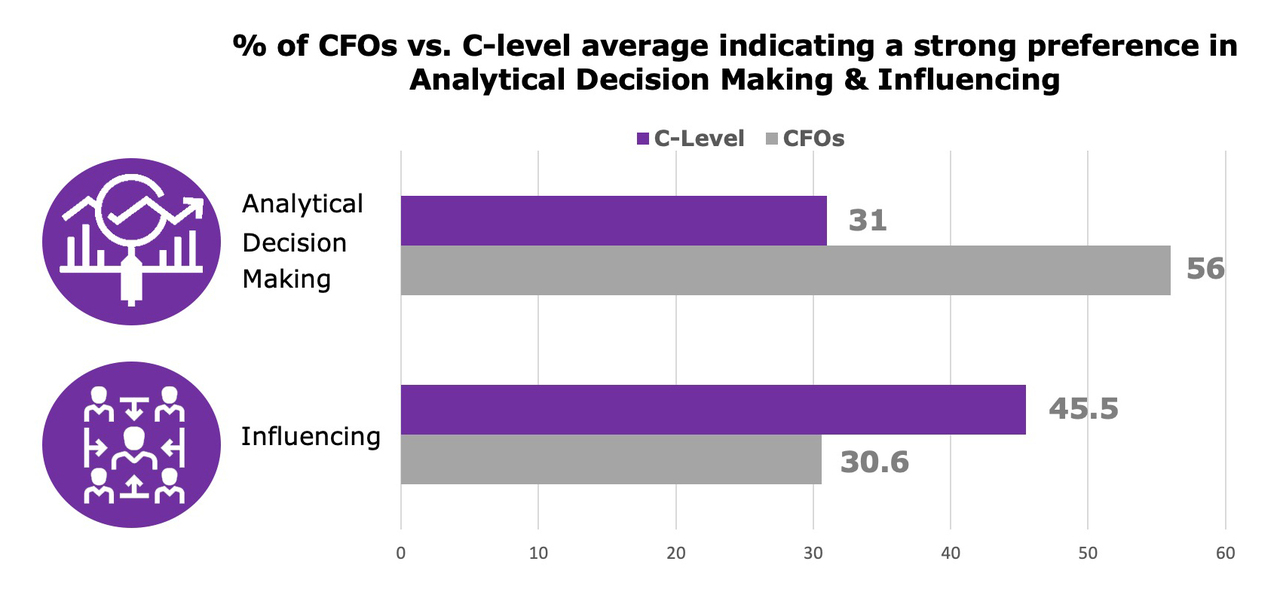

The study of 288 CFOs profiled by PROPHET indicates a statistically significant higher preference for ‘analytical decision-making’ and lower preference for ‘influencing others’ compared with C-suite colleagues: about 80% more CFOs indicate a preference for analytical decision-making, yet around 50% more C-suite colleagues indicate a strong preference for Influencing when compared with CFOs. Both these differences reach statistical significance, using a Chi-squared test.

“The PROPHET Insights that support our executive search and leadership consulting assignments highlight the importance of the CFO’s contribution and their behavior within the C-suite”, comments Victor Escandón, CFO, Boyden. “It is essential that my fellow finance professionals use their different attributes to enhance decision-making and the capabilities of the leadership team in all its thinking and activities, rather than limiting our contribution to financial operations. We are well placed to add strategic value.”

Note: differences between CFOs and the executive population are measured using a Chi Squared test. In each test, P=0. This test determines whether there is a statistically significant difference between the expected frequencies and the observed frequencies in one or more categories.

The PROPHET Study

The PROPHET Study involved 288 CFOs, 2,778 C-suite leaders, and 10,000 from the executive population, profiled during assignments in executive search, on-boarding and leadership development. They come from over 90 countries and typically lead medium or large organizations.

Business implications

With the different preferences of CFOs, the following may be true:

- The CFO is likely to value detailed consideration of all available information, developing analyses and being well prepared for meetings. They may prefer to work alone, carefully thinking things through. Conversely, other C-suite leaders may share evolving ideas before reaching fully-formed conclusions, keeping things simple and proceeding despite analysis being incomplete or imperfect. Consequently, the CFO may see others’ contributions as insufficiently well-considered.

- The CFO may be more likely to let others dominate in meetings, less concerned about winning people over, and playing a more reflective role. The rest of the C-suite may seem more energetic and invigorated around a goal. The CFO may find this unfounded, while colleagues may perceive the CFO as a ‘handbrake,’ and a negative, overly conservative voice.

Getting the best from the CFO

Techniques to leverage CFO preferences:

- Highlight the decisions that require greater depth of thinking and planning. This will harness the stronger analytical preference of the CFO for vital consideration on the best way forward, including their insight and analysis early on. Engaging the CFO too late may lead to collective frustration and wasted time.

- When chairing meetings, ensure the CFO is invited to speak throughout, rather than just at the end. This will guide the team through the process of developing its thinking, including different approaches and perspectives. Before concluding, challenge the CFO to act as the voice of reason; this ensures they do not influence colleagues outside of the room to reverse decisions they perceive as based on shared enthusiasms rather than a rigorous understanding of the detail.

- When a pragmatic approach to decision-making is more appropriate than detailed analysis, the typical CFO may not support decisions based on curtailed discussion. Agree which decisions warrant pace and which merit considered reflection, sharing explicitly which decision-making approach to take. This avoids unnecessary criticism or undermining behavior when people differ in their preferences.

- Help the CFO to value inspiring communication. They may be uncomfortable with sound bites or ‘fluff’ but evocative, visionary communication inspires and engages employees, including their own finance teams. CFOs are more likely to reinforce visionary communication with rigorous explanations, creating even more effective messaging.

This doesn’t reflect me or the CFO I work with

Not all CFOs will conform to this profile; give careful consideration to the type of CFO you are, or with whom you are working. For example, just under 1/3rd of CFOs profiled indicated a strong preference for Influencing, and these CFOs will therefore approach the role with a very different style.

Questions to consider

- Are you appointing, or currently being led by, a typical or an atypical CFO?

- How will the CFO complement the C-suite in decision-making, and how can preferences be understood so colleagues can get the best out of the CFO?

- Is the CFO leveraging their differences to contribute to the whole business agenda?

- How does the CFO come across to the wider organization, and how can senior colleagues support them in their leadership style?

About Boyden and Building High-Performing Teams

Boyden is a premier leadership and talent advisory firm, with more than 70 offices in 45 countries. With over 150 certified practitioners, Boyden uses PROPHET in leadership consulting engagements and also in executive search; fast-tracking the assignment, enhancing the relationship between client and candidate and supporting the successful integration of the appointed executive into their new team.

PROPHET is not used to inform a selection decision, as it is not predictive of performance. It does, however, provide valuable insight on how an individual will approach their role and the style of their decision-making. With PROPHET, the appointed executive and key stakeholders will have an initial understanding of each other’s work preferences, establishing a high-performing business relationship from the outset.

PROPHET (Predictive Role Profiling for High-Performing Executive Teams) is a business-focused profiling tool specifically designed for senior executives. It is both a valid psychometric instrument registered with the British Psychological Society, and a powerful team and organizational insight instrument. PROPHET sheds light into working relationships in a way that is quick and relevant, helping form high-performing teams. It is used globally by organizations of different sizes, across all sectors.