In the summer of 2023, Boyden’s New York team conducted a survey of investment professionals working for asset managers around the subject of compensation and work models. Many investment professionals participated in the survey.

The asset management sector is currently facing challenges and opportunities in equal measure. In a world of ever-increasing regulation, changing interest rates, digital disruption, and rapid growth in the popularity of index tracking or smart beta products, asset managers must adapt and evolve quickly.

Boyden has been at the center of the debate regarding active versus passive investing, helping clients answer how they remain current in active investing as well as sourcing Data Science candidates for the former.

We have been consistently surprised by the wide range of compensation at similar-looking firms. This range can be as much as 400% from the bottom decile to the top decile for the same experience level at the same nature of the firm (long only or hedge fund).

The key drivers for compensation are the size of assets/profitability of the firm and the culture of the organization. Broadly speaking, the larger the AUM and the more profitable the firm, the better paid the analysts. Typically, profitability can be a more reliable indicator of compensation than the size of AUM and this is particularly true for hedge funds.

There is more uniformity of compensation at very large, long-only asset managers than at smaller ones, but even between the large firms, there can be a two-to-one differential for similar-looking analyst jobs at different firms.

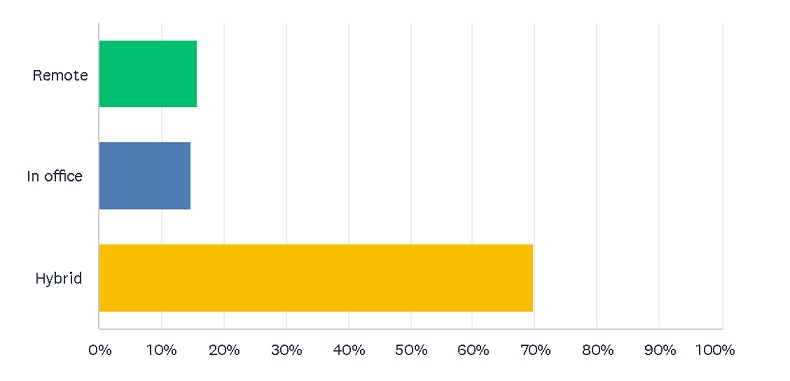

Strong preference for hybrid work

The strongest conclusion from the survey is the overwhelming employee preference for a hybrid work model.

Almost 70% of respondents favored hybrid working compared with 16% preferring remote and 15% in office. Furthermore, when questioned as to whether the work model offered by a firm would affect their decision to accept a job offer, 76% replied in the affirmative.

Which Work Model Works Best for You?