Exploring Trends in Value Creation

- Changing up fund structures

- Diversifying sources of growth

- Portfolios built for resilience

- Deriving value from digital transformation

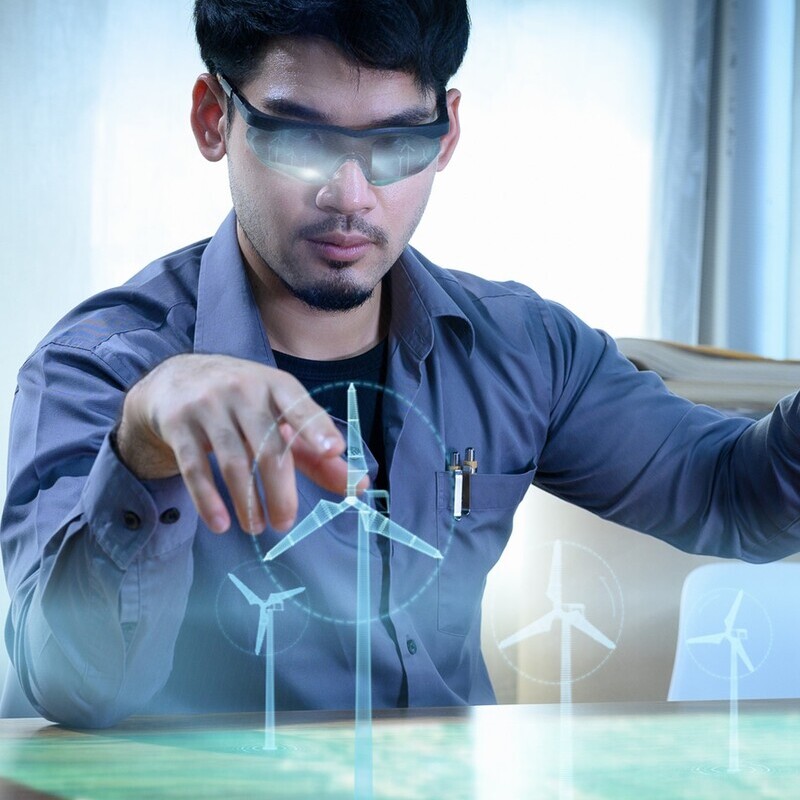

Diving into the ever-evolving world of private equity and venture capital, this series uncovers key trends and insights that are shaping the industry. From redefined value creation approaches to the transformative energy sector, and the evolving ESG landscape to the dynamics of executive talent, we examine critical aspects of today’s PE/VC landscape. This edition spotlights activities across the industrial sector.

“One of the key outcomes of Davos 2023 was that over the next five years, more than half of the tipping points for crucial green technologies will have been met, making them competitive in key markets.

The degree of shock in the macroeconomic environment post war in Ukraine and rampant inflation has taken most CEOs into a place they’ve never been before. In a world that values speed, being an early mover in those new domains and considering ESG as a way to solve growth, talent, and stakeholder concerns could be a game changer.

Private equity investors are uniquely positioned to effect this change, given they generally have controlling ownership of companies. It is not an issue of cost but rather as an opportunity for the entire ecosystem.”

- Anita Pouplard, Global Practice Leader, Private Equity & Venture Capital Practice

- Changing up fund structures

- Diversifying sources of growth

- Portfolios built for resilience

- Deriving value from digital transformation

- Focused investment on energy transition

- Realizing returns by remaking traditional energy companies

- Industrial portfolio fund management in transition

- Growth and resilience in ESG investing

- The greening of industrials

- Shifting focus to the “S” in ESG

- The governance factor

- Creating value by prioritizing talent

- The portfolio CEO revisited

- CFOs wearing many hats

- Operating partners abound